Reading the book Machine Trading from Ernie P. Chang, on the first chapter it offers different oppinions about environments to gather historical data, do backtesting…

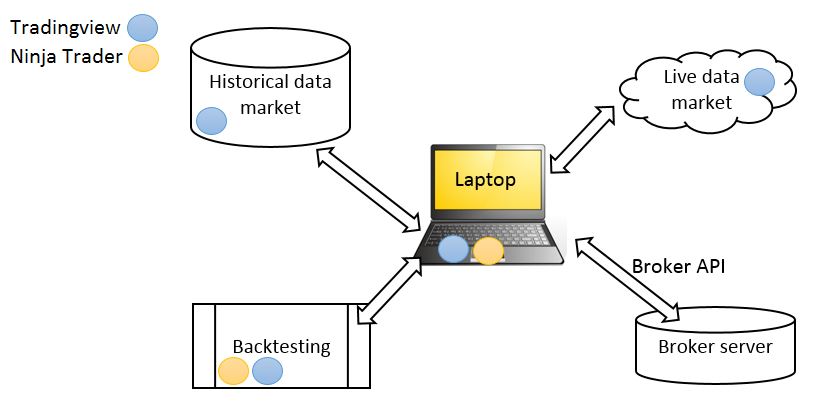

I started to analyze which one of the solutions was better to cover the whole picture proposed in the book. My analysis was basically to compare Tradingview and Ninja Trader.

I started to evaluate Quantopian, as it covers backtesting and the environment to develop is Perl on Notebook (which I am familar with), but I discarded it.

As conclusion, for my initial steps on backtesting I have selected Tradingview as tool to start building backtests scripts.

This one is the first one. It combines a simple strategy between RSI and MACD.

//@version=3

strategy(“Test-1 RSI”, overlay=true, initial_capital=1000, currency=’USD’)

/////////// inputs //////////

// RSI

Length = input(14, minval=1)

Oversold = input(25, minval=1)

Overbought = input(70, minval=1)

// MACD

fastLength = input(12)

slowlength = input(26)

MACDLength = input(9)

/////////// individual long conditions //////////

// RSI

rsiLongCondition = rsi(close, Length) < Oversold

// MACD

MACD = ema(close, fastLength) – ema(close, slowlength)

aMACD = ema(MACD, MACDLength)

macdDelta = MACD – aMACD

macdLongCondition = crossover(macdDelta, 0)

/////////// long condition //////////

// RSI and MACD

if (rsiLongCondition and macdLongCondition)

strategy.entry(“Long 1”, strategy.long)

/////////// individual short conditions //////////

// RSI

rsiShortCondition = rsi(close, Length) > Overbought

// MACD

macdShortCondition = crossunder(macdDelta, 0)

/////////// short condition //////////

if (macdShortCondition)

strategy.close(“Short 1”)