This article is gold, I have learned a lot about the basis of the theory of money and token valuation. Thanks Jay Pazos for sharing it.

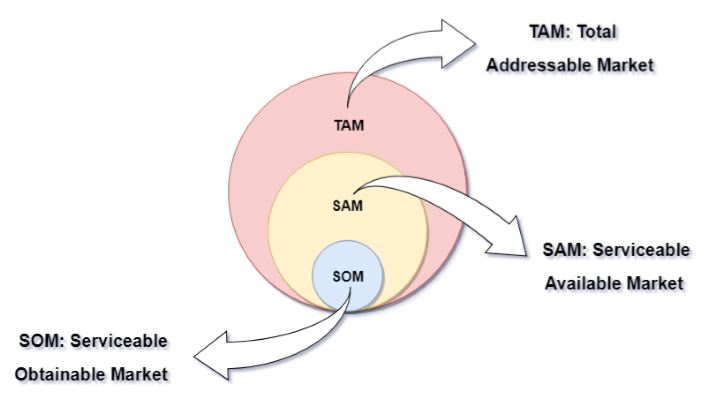

Acronyms to remind:

- TAM: Total addressable market.

- SAM: Serviceable available market.

- SOM: Serviceable obtainable market, the market that the company can realistically address.

- PSOM: %market penetration of the company in SOM.

- Q: quantity of the resource provided.

- Q = SOM x PSOM

Abstract

Ok, you do not have time to read the 6 pages article, just read the abstract, I guess it will convince you to read the rest.

A framework to value utility tokens would allow for more transparent Initial Coin Offerings (ICO) and help in the development of digital assets. In this paper, we derive a formula to value utility tokens and the network that supports it. We found that valuation is directly proportional to the price of the resource being provided and the size of the Serviceable Obtainable Market (SOM) for that resource. Also, it is inversely proportional to the velocity of the token. In section 4 we derive a formula for a crypto conversion factor that relates the price of the token to the price of the resource provided, the factor is not linear and has seven variables. For cases where the growth of SOM and the growth in price of the resource are not high, longer times to develop the network will

decrease valuation; this is because discount rates for start-up and growth companies are high. On the other hand, if the build-up of the network goes on-time as planned, posterior valuations of the network will yield higher values. As expected, valuation doesn’t depend on the number of tokens issued as that variable doesn’t appear in the formula. We believe that by making these formulas available to the Blockchain/DLT community,

we can help network developers to understand how key variables impact the valuation of the network they are trying to build.

.