I have been drawing this map as part of a conversation on slack with other user (Tom) where I was trying to figure out what map and needs are required.

So I started with the user: the algorithmic trader. This person wants to implement an algorithm for executing trades automatically without human intervention. So, the design of a system, the back-test of the algorithm and the execution of the final tested code are its main needs.

Then, you could decide if to do it by yourself or using one of the existing platforms. I know Quantopian a little bit, so I have used this one as reference for the map (you can use others).

I have drawn the lines in different colors to differentiate the selection of a user that wants to take one route or other: user that builds its own environment (green) or that uses a platform (orange).

I have doubts with the practice, in the few knowledge I have, practices depends more on the models and technique that an author writes about.

The Wardley Map

The typical steps that an algorithmic trader do are:

- Design the system starting defining the trading rules that wants to put in place. Once done it’s moved into an algorithm.

- The algorithm is tested on a data set, and results are evaluated through a set of indicators and standard values that traders use to work with.

- Once a tested algorithm is considered as valid, the code is executed in production with real money.

Key aspects of the map:

- Real time data is key for the execution of the code, specially if the algorithm works well in small spaces of time. There is a big space of work here and the competition with high frequency traders is tough.

- The connection with the broker is key, a platform as Quantopian that used to have it, removed it. The brokers uses to enable APIs for connections from external computers. Here again the time response is key.

- One of the advantages of Quantopian is that they offer a prepared datasets that in the past had high quality. This makes you save a lot of time because the preparation and maintenance of data is something that is very time consuming.

- I have not represented concepts as risk management, as this is something conceptual that the algorithm trader has to implement in the code following the principles, rules and systems that is more valid for him/her.

Quantopian Business model

This Bostonian company has two main lines of business are:

- Developer members, who develop and test algorithms for free, focusing on specific factors that, in case they are winning algorithms, can be added to Quantopian’s offerings to institutional investors. In this case they can have some royalties or commissions.

- Institutional investors, have their investments managed by the winning algorithms.

There were a moment where they took a decision

In 2017, Quantopian decided not support the connection with live trading brokers

I have read this note, where it’s announced that Quantopian no longer supports live trading through Interactive Brokers (or Robinhood). Here, the users are moving to other environments, some of the ones mentioned are:

- Quantconnect,

- ZipLine Live (the project is no longer maintained)

- IBridgePy,

Reading the comments of the forums, it seems that the solutions are not perfect, but the users are surviving using other environments. The users having their own environment must be laughing.

The point is, Quantopian wanted to have a free environment to promote winning scripts and then use them with their institutional investors. To have real winning algorithms you need real competition that forces people to find higher profits, not just a mediocre profit that an individual could use to earn some dollars. They probably identified that real competition was invaded by average brokers that wanted to take advantage of a free environment, and they cut the umbilical cord for these average brokers.

Announcement on October 29th

Quantopian’s Community Services are Closing, this is the title of the note published to announce the closing of the Research and Backtesting are no longer available.

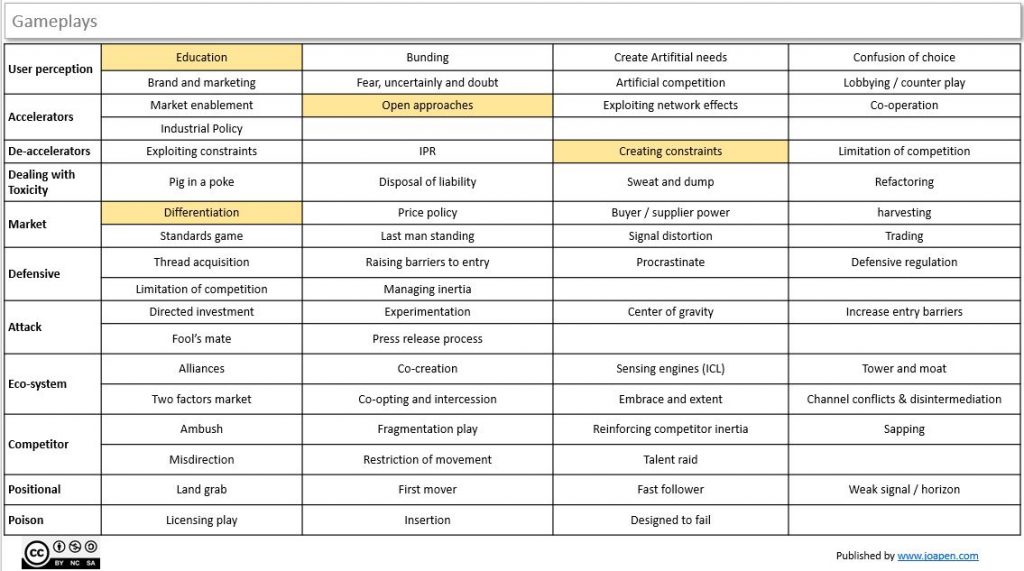

Gameplays

We can identify two sets of gameplays used by Quantopian:

- Education: they have had a clear approach to educate people and the amount of educational content is really extense and high quality.

- Open approaches: the use of python as programing language enabled them to attract a lot of researches that are used to work with it, and to take the advantage of libraries as Zipline.

- Differentiation: they were offering the institutional investors a set of algorithms that were tested and they had real winning percentage and profits. The market is very extense, and to have an “army of researchers” looking for weird correlations that leverage profits for “free” is something definitely different.

- Creating constraints: the removal of access to live brokers was an invitation to some set of users to leave the environment. I can imagine that they took the number of users connected to brokers, and they easily calculated the amount of resources that they were consuming.

Which other gameplays do you identify?

Which other platforms exist?

I found this picture in https://tradingtuitions.com/ that is very useful to understand some of them: