When you analyze REITs traditional metrics such as earnings-per-share (EPS) and price-to-earnings (P/E) do not apply.

Funds from Operations (FFO)

For most businesses, depreciation is an acceptable non-cash charge that allocates the cost of an investment made in a prior period. But REIT’s behavior is different because property often appreciates its value. This affects the Net income in a negative way.

By this reason it’s better to use funds from operations (FFO) for REITs.

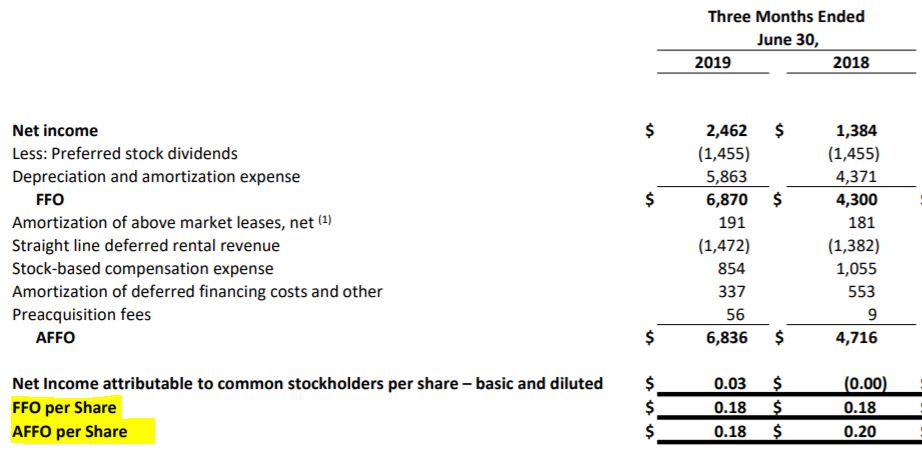

In the quarterly reports you can find FFO along with net income.

FFO weaknesses

It does not deduct for capital expenditures required to maintain the existing portfolio of properties. Real estate holdings must be maintained (painted, repaired…) so FFO is not quite the true residual cash flow remaining after all expenses and expenditures.

What can we do? Use Adjusted FFO (AFFO) it is a more precise measure of residual cash flow available to shareholders.

FFO is a Non‐GAAP Financial Measures

You can find in the financial reports of REIT companies this disclaimer:

FFO and AFFO are non‐GAAP financial measures within the meaning of the rules of the SEC. The Company considers FFO and AFFO to be important supplemental measures of its operating performance and believes FFO is frequently used by securities analysts, investors, and other interested parties in the evaluation of REITs, many of which present FFO when reporting their results. In accordance with the National Association of Real Estate Investment Trusts’ (“NAREIT”) definition, FFO means net income or loss computed in accordance with GAAP before noncontrolling interests of holders of OP units and LTIP units, excluding gains (or losses) from sales of property and

extraordinary items, less preferred stock dividends, plus real estate‐related depreciation and amortization (excluding amortization of deferred financing costs and above‐market lease amortization expense), and after adjustments for unconsolidated partnerships and joint ventures. Because FFO excludes real estate‐related depreciation and amortization (other than amortization of deferred financing costs and above market lease amortization expense), the Company believes that FFO provides a performance measure that, when compared period‐over‐period, reflects the impact to operations from trends in occupancy rates, rental rates, operating costs, development

activities and interest costs, providing perspective not immediately apparent from the closest GAAP measurement, net income or loss.

FFO and AFFO for Global Medical REIT Inc. (GMRE)