The story of the ETFs linked to cryptos started in 2013 with the first formal request. It was done by Winklevoss Bitcoin Trust, proposed by Cameron and Tyler Winklevoss. They requested it 7 times starting in 2013: all rejected.

The ones that have obtained the approval now have been:

- Grayscale Bitcoin Trust (GBTC): the first to officially convert to a spot ETF.

- Hashdex Bitcoin Futures ETF (DEFI)

- Franklin Bitcoin ETF (EZBC)

- VanEck Bitcoin Trust (HODL)

- iShares Bitcoin Trust (IBIT) by BlackRock

- Ark 21Shares Bitcoin ETF (ARKB) by Ark Invest

- Valkyrie Bitcoin ETF (BTF)

- ProShares Bitcoin ETF (BITO)

- WisdomTree Bitcoin Trust (WBIT)

- Galaxy Bitcoin ETF (BTCG)

- One River Bitcoin ETF (ONEB)

My initial thoughts

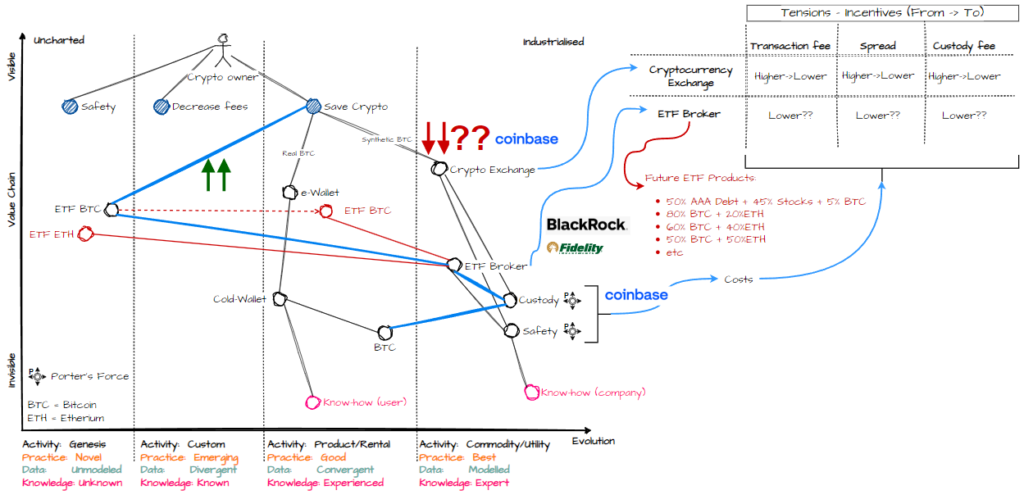

My initial thoughts were that a ETF of just Bitcoin makes no sense. It makes sense to build an ETF that have different types of assets and then you can diversify with them. For instance an ETF that could have: 80% Bitcoin and 20% Etherium.

I was wrong.

But then I fall into the consideration that some firms could offer something like: 90% S&P 500 and 10% Bitcoin.

Digging into incentives

Then I miss one of the more important points and they are incentives. In these type of products, commissions represent an important incentive for investors and the current crypto market is very expensive.

what is the role of Coinbase in this bitcoin ETF process?

Coinbase was one of the pioneers in the crypto market and it has also lead the market creation in US with a clear approach to gain volume and have had the SEC in front of them requesting many information related to the P&L of the users (taxes purposes) and many other similar things.

Right now Coinbase is one of the leaders in Bitcoin, but the appearance of the BTC-ETF makes them to be the main custodian of the ETFs. 8 of the ETFs approved in the list above have their bitcoins custodied by Coinbase.

These new products are going to generate new diffusion layers where the expectation is that more customers start investing into crypto through these products.

This is a bad news for Coinbase, because they have not their own ETF. The have been moved down in the value chain and in the future they will potentially be a big custodian, but that’s it.

A Wardley map

Right now, I see the situation as below:

- ETF Brokers are going to increase their position slowly on BTC, which will make the capital flows to move from one place to other. If companies as Fidelity and Blackrock add BTC in their products, this is going to become a high growth of BTC volumes in that direction. I consider the US market only, so I do not know what would be the effect in the price of the BTC (which is global).

- Crypto exchanges, it could be that in the short term the volumes go down (that’s the reason to add “??” to that dependency), but in the long ride I would expect new layers of adoption and a growth there too.

Related to the symbol with the “P”

I have used a symbol that is available in the library published by Julius Gamanyi related to Porter’s five forces. I have used that symbol to highlight the tensions existing in that part of the map.

This article from Vanguard: “No bitcoin ETFs at Vanguard? Here’s why“, is a good information to take into account. Once they change their opinion (if they finally do), it will be a strong signal.

As usual, any constructive feedback is welcome!