Disclaimer: This analysis is based on publicly available information and should not be construed as investment or medical advice.

I have a lifestyle that is considered healthy (do sport, good eating habits…) and I was shocked some months ago when I learned from a friend that stayed in an AirBNB apartment and the host had the fridge full of weight loss drugs.

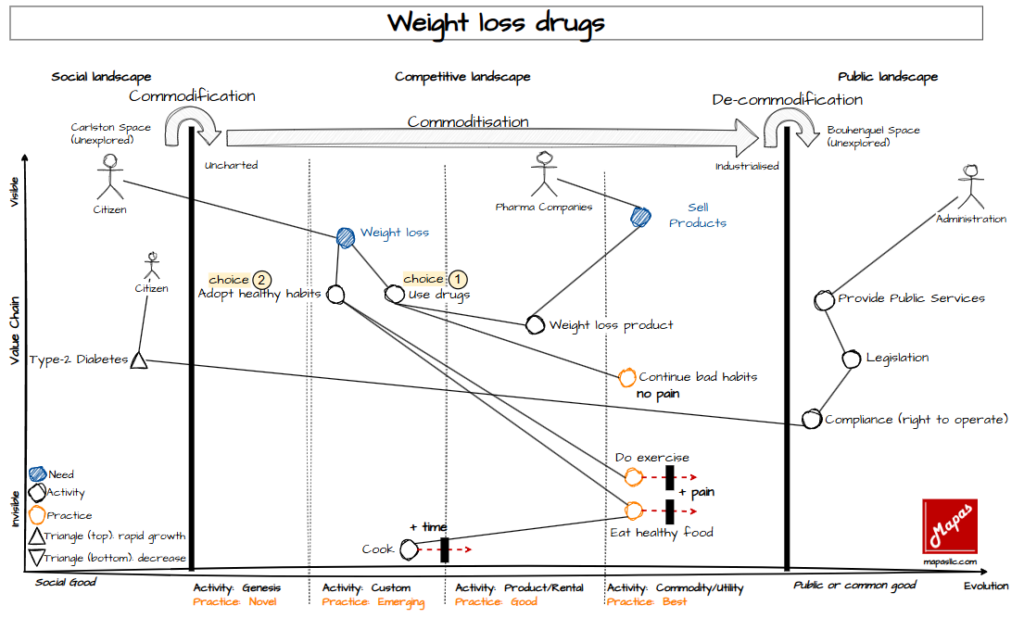

I put my ideas on paper and after reading about it, I did this Wardley map:

The question that came to my mind

The main question that came to me is: What will be the choice that will increase more in the following years? choice 1 (use drugs) or choice 2 (adopt healthy habits). I have not answer to this question, I have the hypothesis that both are going to grow, how?

Choice 1 (use drugs)

It’s going to grow because:

- There are groups of people that have demonstrated that do not have tolerance to pain.

- There are groups of people that have a set of priorities where health is not part of the list, but they want to look good.

- There are groups of people that accepts medicines as part of their lifestyle.

Choice 2 (adopt healthy habits).

It’s going to grow because:

- There are groups of people that are aware of how important is to take care of themselves.

- There are groups of people that love to show through social networks how healthy they are (where it does not mean they really are).

- There are groups of people that having a healthy lifestyle is part of them.

The second question that came to my mind was: who is selling the Weight-Loss drugs?

The answer:

- Novo Nordisk: the leader right now with Wegovy and Ozempic. This was initially developed for diabetes but the fact that showed significant weight-loss benefits, it’s making that people is consuming it for this secondary effect.

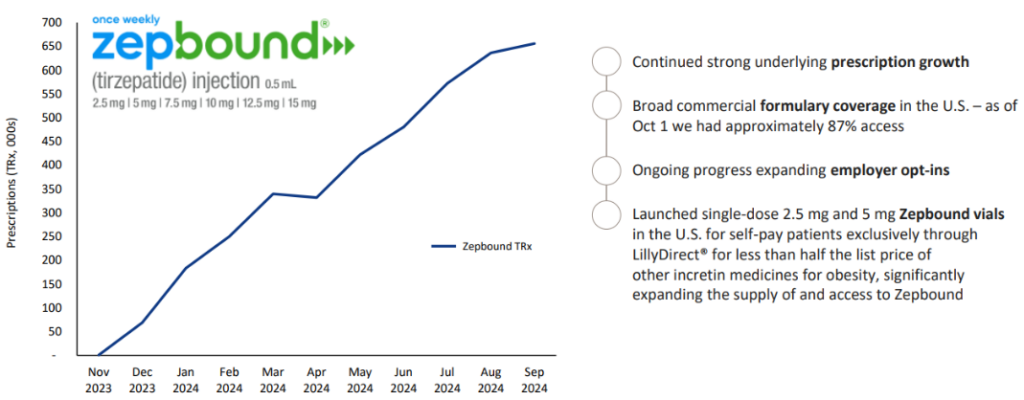

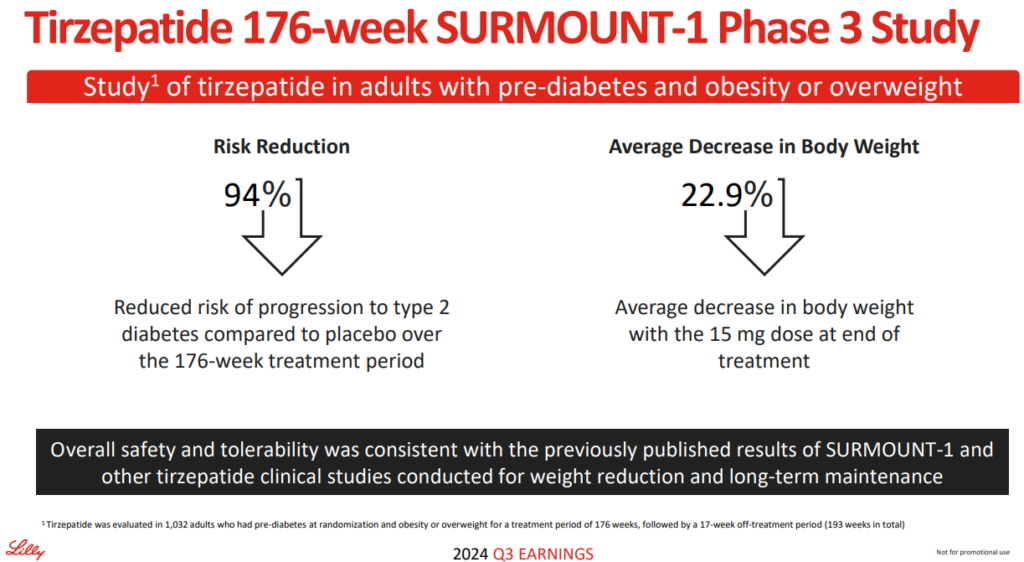

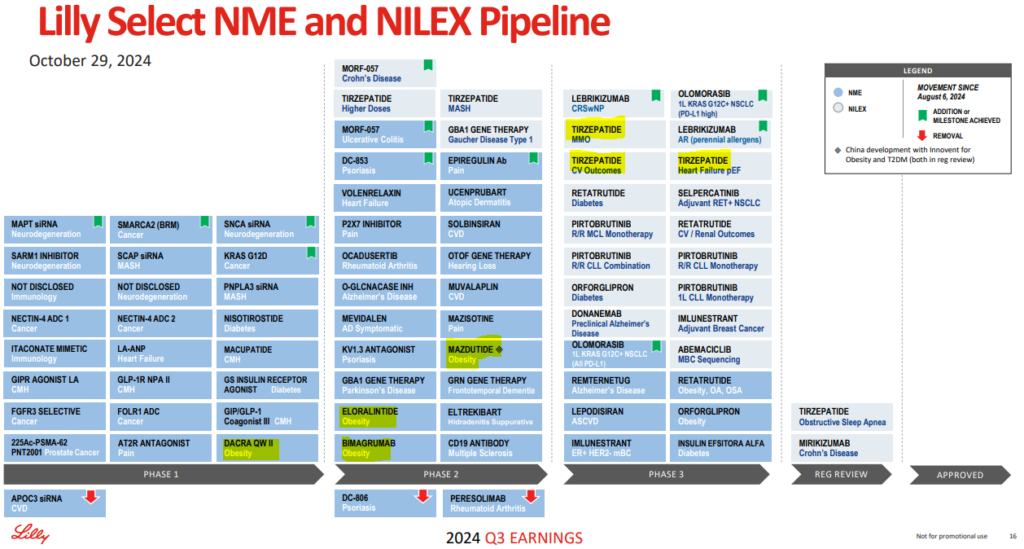

- Eli Lilly is considered the rising contender with tirzepatide (Mounjaro), demonstrating even greater weight-loss potential than semaglutide (Wegovy/Ozempic from Novo Nordisk).

- Other companies trying to get similar products:

- Pfizer: Developing new obesity treatments.

- Amgen: Exploring therapies targeting obesity.

- Biohaven Pharmaceuticals: Focuses on CGRP receptor antagonists for obesity.

The third question that came to my mind was: is there a market?

I looked into the Lilly quarterly report and I found these diagrams:

From Novo Nordisk Novo Nordisk, I found:

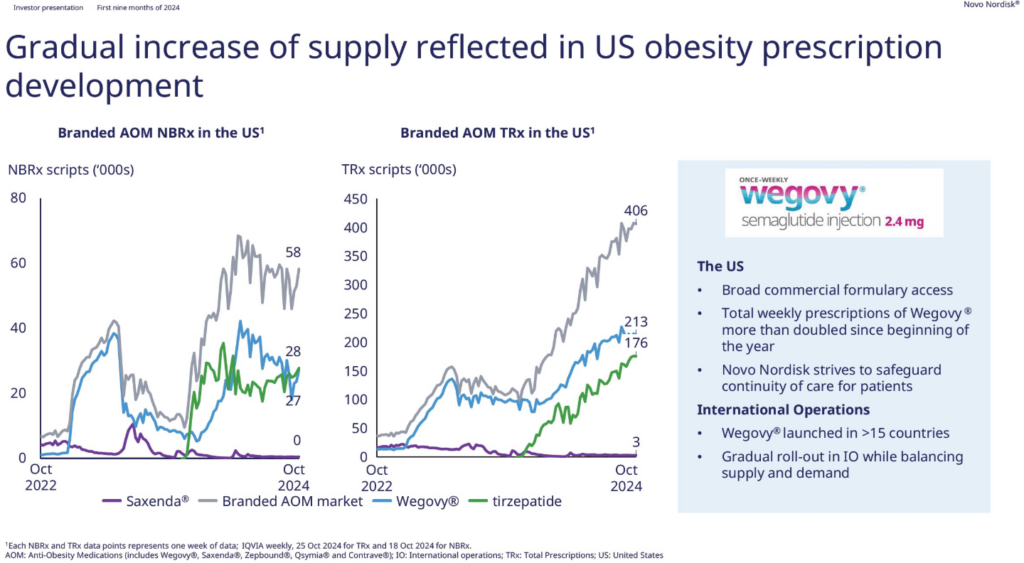

Numbers and trends of consumption:

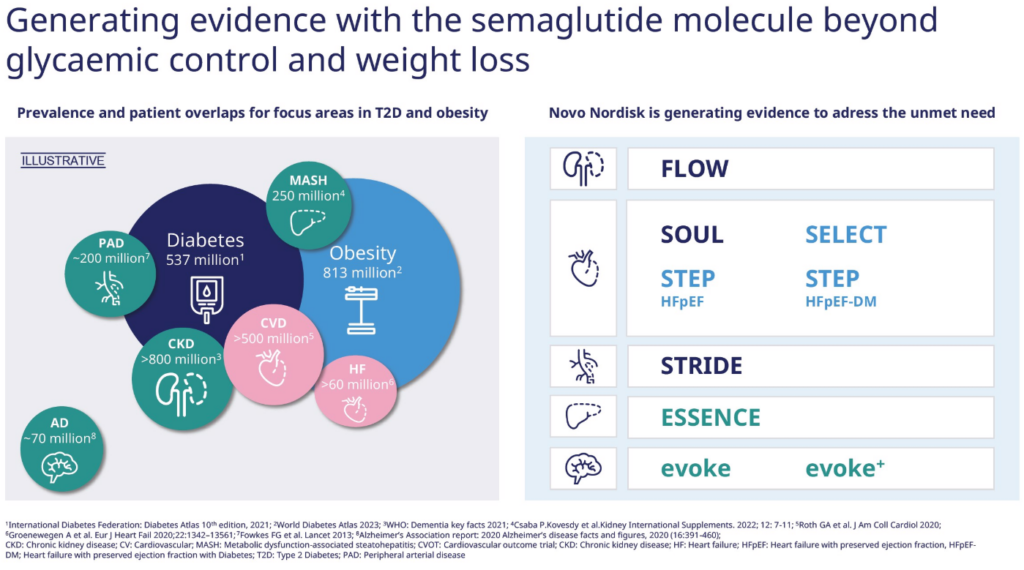

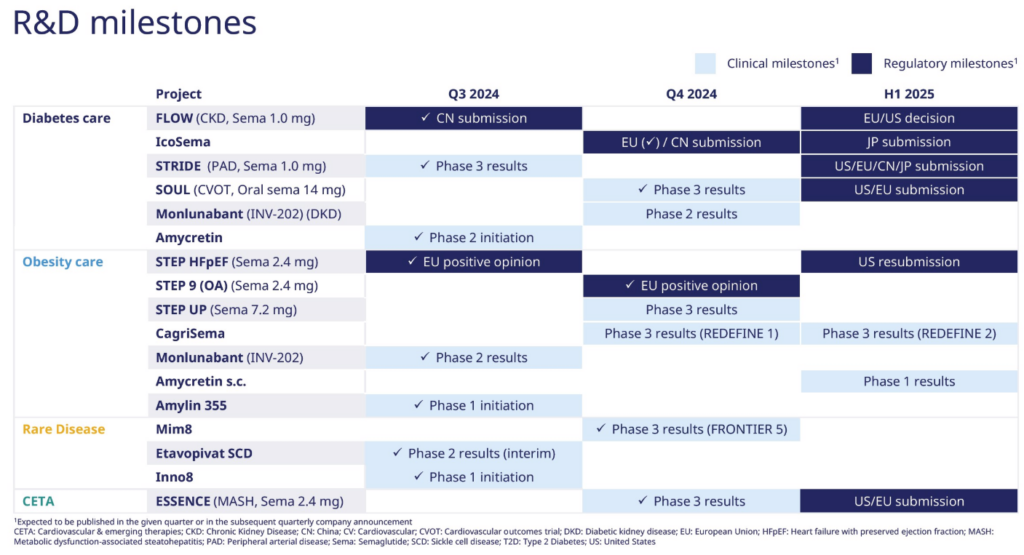

Evidences about how they play the game:

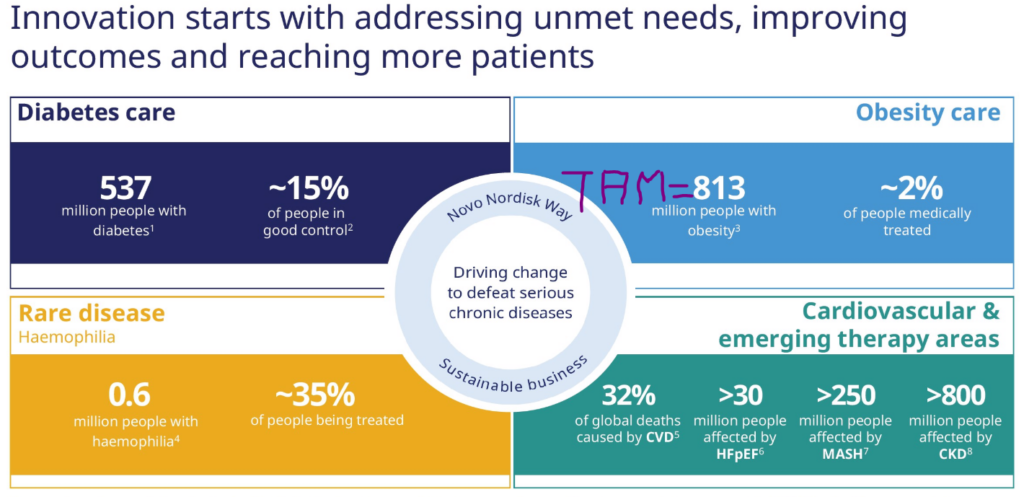

Obesity is a category in their portfolio:

TAM = Total Addressable Market, estimated in 813 million people.

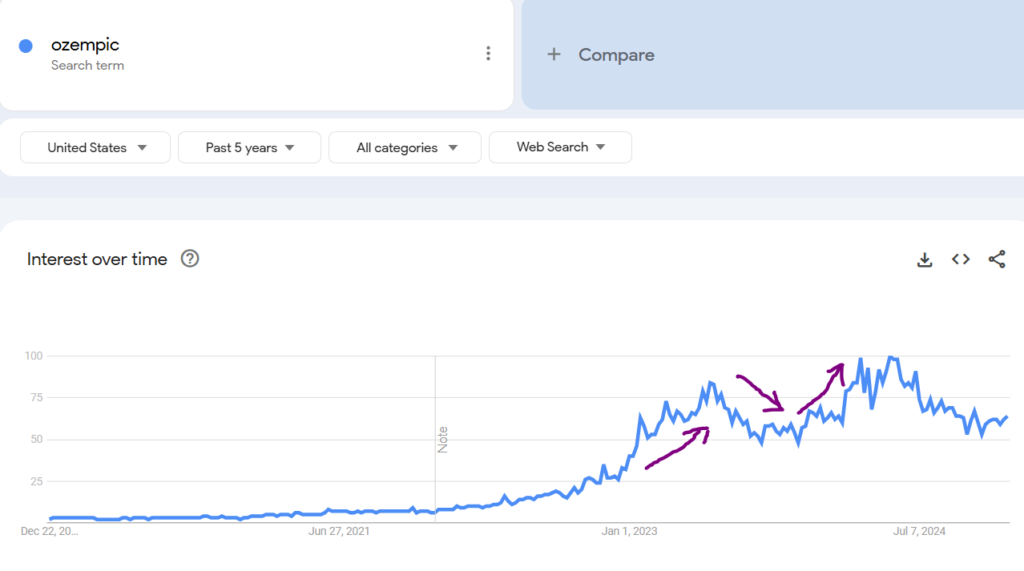

Google Trends talks

and says that during the first half of the last 2 years Ozempic searches increased.

Let’s look at the tailwinds and headwinds

for these companies of the pharma industry

| Headwinds | Tailwinds |

| – High Costs: These medications can be expensive, potentially limiting accessibility for some patients. Right now they are not included in the insurances in the US. In Spain is being prescribed for Diabetes patients. – Side Effects: Some patients experience side effects like nausea, diarrhea, and fatigue. – Long-Term Safety: Long-term safety data is still emerging (not really known) for some of the newer drugs. – Potential for Abuse: There are concerns about the potential for misuse or abuse of these medications. – Regulatory Scrutiny: Regulators are probably monitoring the evolution of these drugs. | – Growing Market: The global obesity market is projected to grow significantly (now estimated in 813 million people by Novo) . – Favorable Reimbursement: Payers are recognizing the value of these medications in managing obesity-related conditions. – Technological Advancements: Companies continue investing on R&D for these products. |

Takeaways

The human behavior fascinates me.