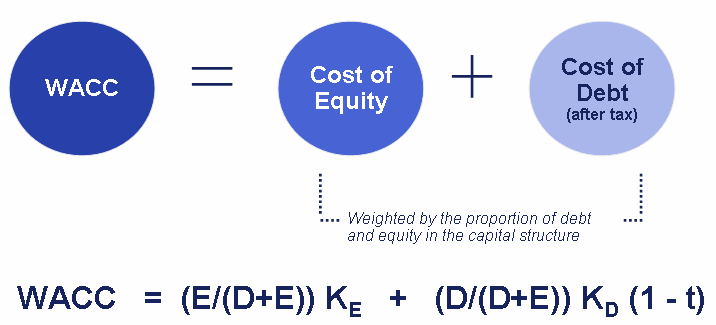

Weighted Average Cost of Capital (WACC)

A calculation of a company’s cost of capital in which every source of capital is weighted in proportion to how much capital it contributes to the company. For example, if 75% of a company’s capital comes from stock and 25% comes from debt, measuring the cost of capital weights these accordingly. A high WACC indicates that a company is spending a comparatively large amount of money in order to raise capital, which means that the company may be risky. On the other hand, a low WACC indicates that the company acquires capital cheaply.

Return on invested capital (ROIC)

The amount, expressed as a percentage, that is earned on a company’s total capital calculated by dividing the total capital into earnings before interest, taxes, or dividends are paid.