One of the most interesting things that I read on Systematic trading by Robert Carver is the tendency that a trader can have when doing his transactions.

The concept

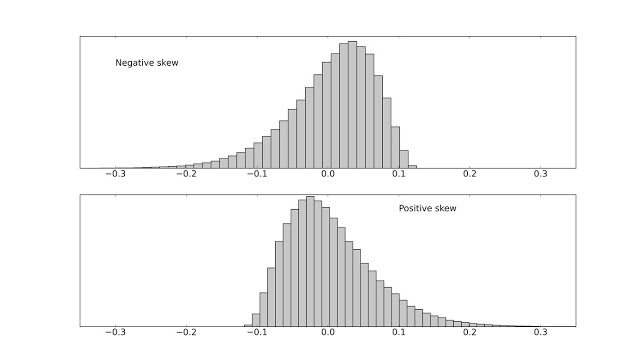

Basically when you are completing a long-short action (completed transaction), ideally you will have positive outcomes and negative outcomes. If you accumulate all these results and you order it, you will have a Gaussian bell. This bell will not be perfect, it will have different shapes.

The trader with negative skew, will have:

- high number of transactions are completed positively, with small amounts of profit.

- Few amount of transactions are completed in a negative way, but with high loses.

The trader with positive skew, will have the opposite situation.

It’s important to understand the way you make decisions, the results they return and identify the pattern of behavior you have.

Once done, you can identify the weaknesses of your behavior and then include some habits on your trades to be able to improve your trading in a systematic way.

I generally act as negative skew trader

For a negative skewed trader, there are ways to minimize the negative skew. The main ones are:

- Use stop loss to cut the loses.

- Use stop loss to not directly sell a stock but protect the minimum margin while you let it grow and grow.

- Divide the longs in 2 moves, to decrease the average cost.

Other times I act as positive skew trader

And these times is when I use to manage better the capital that is involved in the trade.