Abstract

In his book “Mastering the trade”, John Carter proposes a simple system based on the moving averages of 8 and 21.

I have implemented the basis of this system and I have changed some behaviors:

- I added the Squeeze momentum indicator to filter the positive trend and reduce the draw downs.

- I have not added any stop-loss.

I have build this system on Tradingview and I have done some back-testing in 3 periods to see how it works.

The system

The system code is this one:

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © joapen

//@version=4

strategy("Carter EMA(8/21)", overlay=true)

// === BACKTEST RANGE ===

FromMonth = input(defval = 1, title = "From Month", minval = 1)

FromDay = input(defval = 1, title = "From Day", minval = 1)

FromYear = input(defval = 2020, title = "From Year", minval = 2000)

ToMonth = input(defval = 12, title = "To Month", maxval = 12)

ToDay = input(defval = 31, title = "To Day", maxval = 31)

ToYear = input(defval = 2020, title = "To Year", maxval = 2020)

//

// SQZMOM

//

length = input(14, title="BB Length")

mult = input(2.0,title="BB MultFactor")

lengthKC=input(20, title="KC Length")

multKC = input(1.5, title="KC MultFactor")

useTrueRange = input(true, title="Use TrueRange (KC)", type=input.bool)

// Calculate BB

source = close

basis = sma(source, length)

dev = multKC * stdev(source, length)

upperBB = basis + dev

lowerBB = basis - dev

// Calculate KC

ma = sma(source, lengthKC)

range = useTrueRange ? tr : (high - low)

rangema = sma(range, lengthKC)

upperKC = ma + rangema * multKC

lowerKC = ma - rangema * multKC

sqzOn = (lowerBB > lowerKC) and (upperBB < upperKC)

sqzOff = (lowerBB < lowerKC) and (upperBB > upperKC)

noSqz = (sqzOn == false) and (sqzOff == false)

val = linreg(source - avg(avg(highest(high, lengthKC), lowest(low, lengthKC)),sma(close,lengthKC)), lengthKC,0)

// lime green red marron

sqzLong = iff( val > 0, iff( val > nz(val[1]), true, false), iff( val < nz(val[1]), false, true))

// Plots

plot(upperBB, title="BB", color=color.green)

plot(ema(close,8), title="EMA(8)", color=color.orange)

plot(ema(close,21), title="EMA(21)", color=color.red)

longCondition = (ema(close, 8)> sma(close, 21)) and (close < ema(close, 8) and sqzLong) and time > timestamp(FromYear, FromMonth, FromDay, 00, 00) and time < timestamp(ToYear, ToMonth, ToDay, 23, 59)

alertcondition(longCondition, title='Long', message='long!!!')

if (longCondition)

strategy.entry("My Long Entry Id", strategy.long)

shortCondition = (close > upperBB ) or (ema(close, 8)< sma(close, 21) or val<0) and time < timestamp(ToYear, ToMonth, ToDay, 23, 59)

alertcondition(shortCondition, title='Short', message='short!!!')

if (shortCondition)

strategy.entry("My Short Entry Id", strategy.short)

Back-testing conditions

- Amount = 100.000$

- Commission = 0$

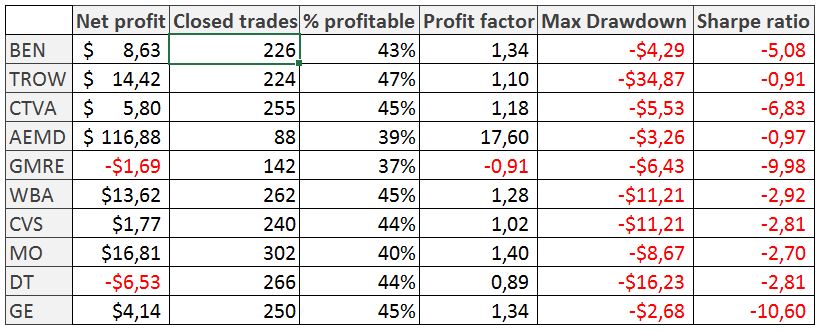

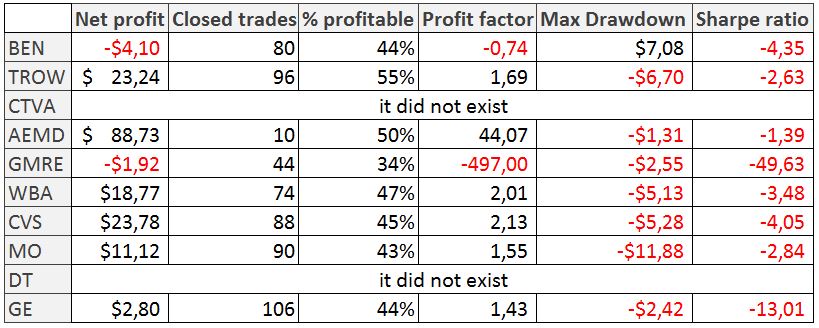

- List of companies: fix list of companies I know with different behaviors, volatility and industries: BEN, TROW, CTVA, AEMD, GMRE, WBA, CVS, MO, DT, GE.

Quality of the samples:

- Minimum around 200 trades to consider a good amount of cases.

- Share Ratio > 1

- Profit Factor > 2

Back-testing results for first date range

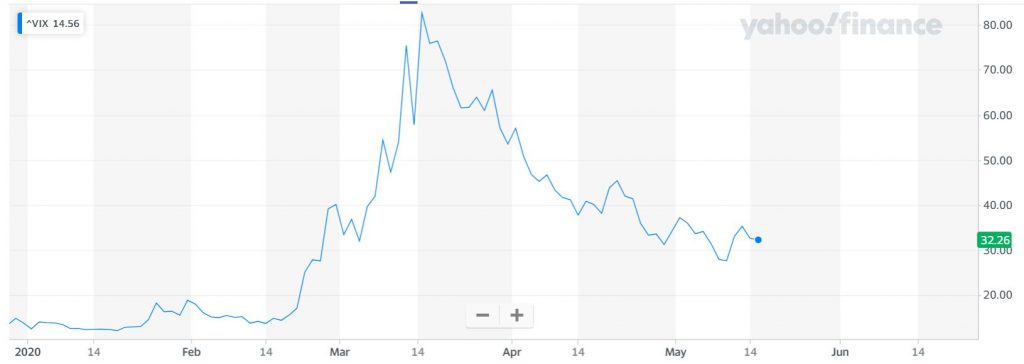

- Date range = 1/1/2020 – 13/05/2020

- Time frame = 5 minutes

Volatility during this period have been so high:

Back-testing results for second date range

- Date range = 1/1/2019 – 13/05/2019

- Time frame = 15 minutes (Tradingview does not enable me to do it in 5 minutes)

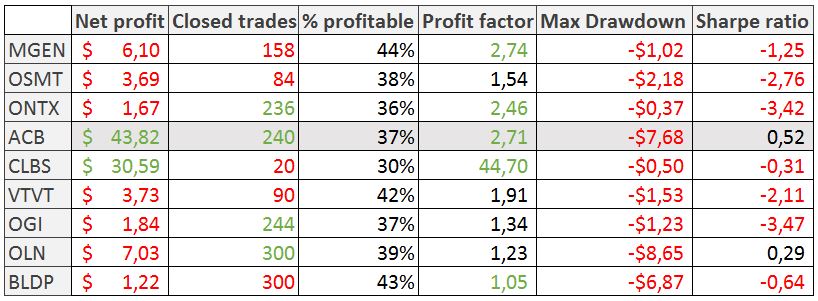

Back-testing results for bio companies in 2020

- Date range = 1/1/2020 – 13/05/2020

- Time frame = 5 minutes

Conclusions

15/05/2020

- I have to improve or discard this system.

- Check when the market trend is better.

- Check when volatility is lower.