Background and goal

The NBA have been building capabilities as organization since its inception. The visualization of the game on TV is one of the biggest sources of revenue to the league, till such point that the salary cap of the teams depends on the main TV contract.

League Pass is a streaming service that is offered to users, but it is a capability that is being build by the NBA with different purposes.

First, the NBA is an organization with a high dependency on the TV contract. As commented, the main TV contract defines in some way the salary cap defined for the teams, and hence the money available for players and their contracts.

Second, ESPN, the TV channel with the major contract is squeezing this contract is a success way that makes the NBA to think about how many dollars they are leaving on the table for not being able to manage their own TV channel. In the 90s, commissioner David Stern tried to build a TV channel, but it did not work as expected.

Third, the streaming services are growing up a lot (Netflix, HBO, Prime…) and this means two things. First, the way the users consume content is changing; second, there is room for building capabilities in the long term and try to compete there. The NBA cannot cover the current space of the TV market, but is willing to build capabilities to compete in the streaming space and neutralize the TV. In strategy it’s always said that to compete for a current space and improve your position is much difficult that try to compete for a future space. This is what the NBA is doing here.

The purpose of this post is to review a little bit how these capabilities are being built in US and internationally, focusing on Spain as it’s the market I know.

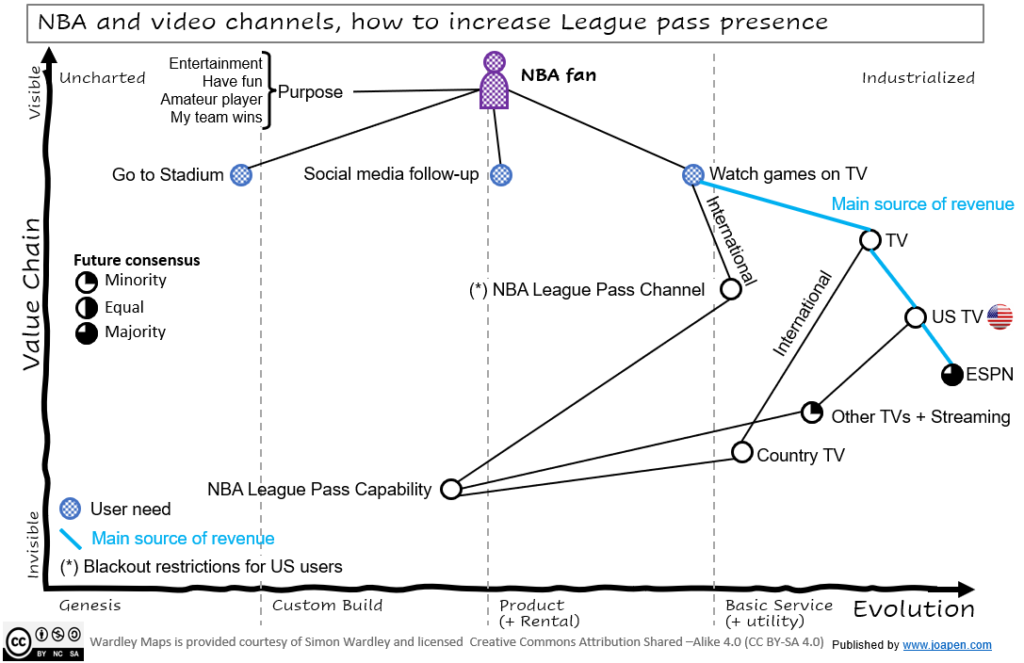

The main map

The NBA fan consumes NBA using different channels, and the main source of visualization is still the TV. The main TV contract drives the rest of the channels, and this contract restrict the use of the streaming services, specially in US (mark in blue as main source of revenue).

League Pass is a capability that is being build and it’s composed by many sub-components and assets.

There is no way to understand the number of subscribers to NBA league pass. This must be one of the best secret in the organization. Companies hide and show metrics depending on the need, and as NBA is a private company, they hide one of the most valuable data. The main thread is the next negotiation with TV.

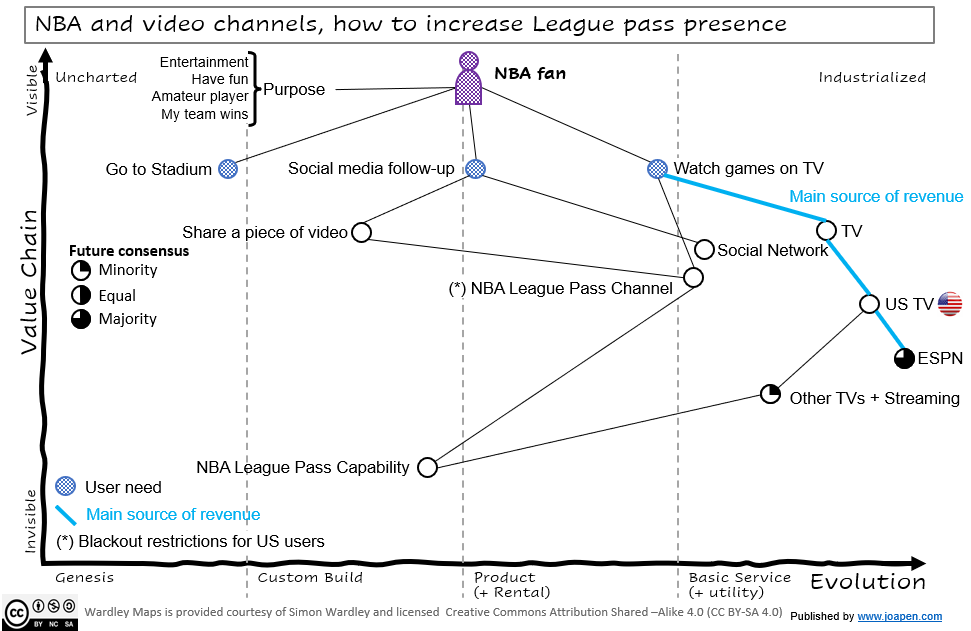

Focus on global users and US

This map highlights some of specific capabilities that attends customer needs.

Other TVs + streaming

League Pass is being offered by different TV channels and streaming channels. This is right now a minimum volume but it allows NBA to improve their capabilities and understand how the users consume streaming services for a professional sport.

This last point is very important as the visualization of games and the use of social networks is linked and being combined by NBA fans. Some fans take short videos and share them into social network (Instagram, Facebook, TikTok, Twitter…) and they can do it easily accessing through League Pass.

The position the NBA have with respect this type of use is clear: they are acts of marketing for free. This position can change in future, but right now it is seen as positive sign.

Blackout restrictions

The main TV contract has some restriction to the visualization of games (NBA blackout policy). For instance, If a local team is playing and the game is televised in the home market, the associated feed on League Pass is blacked out and unavailable for viewing.

These restrictions change with the renewal of the contract and it’s a good point to understand how the presence of League Pass increases.

The current contract with TV

The current contract goes from 2016-17 season till 2024-25 season. The estimated amount of the contract is $2.6 or $2.7 billion per year for the NBA.

The previous contract was around $930 million so it means an increase over 200%.

The contract is signed between NBA in one side and ESPN with Turner Sports on the other side of the table.

This is an anecdote, but gives you some flavor of what’s going on; Charles Barkley signed a 10 years contract with TNT for $317m.

Let’s talk about the TV contract renewal

There is not so much information about the terms of what’s being discussed around the new contract. What is published is that NBA is pursuing a 9 years contract with amounts between $70 – $75 billion dollars.

The current $2.6 billion TV contract set the salary cap till $112.4 million. With a potential $5.7 billion TV contract salary cup could jump into $175 million.

The figures are not exact, but many players and their agents will take into account that season to extend contracts.

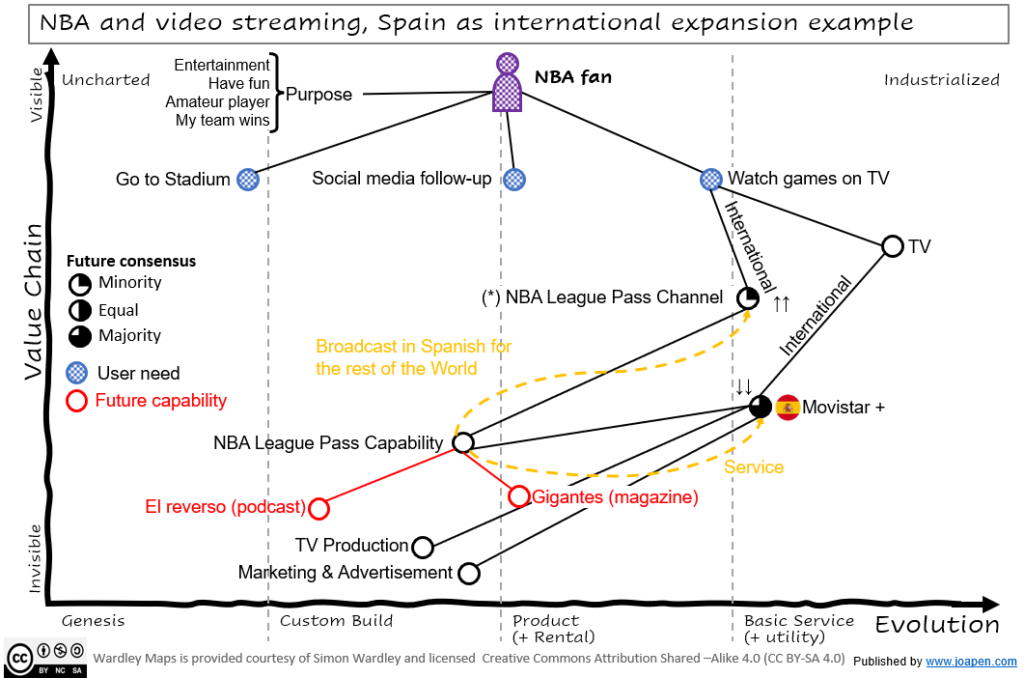

International expansion

NBA continues expanding, and League pass goes behind all programs and activities launched by NBA through different countries, directly through the customers or through specific agreements with traditional TV companies. I will focus on the case of Spain that is the one I know better. This does not mean that all countries are the same, in fact every single country is different.

I have done a map with what I consider it’s the situation in Spain.

NBA started to be shown in Spain in the 80s, this was done through the National TV company first and Canal Plus later. Canal Plus was integrated in what we call Movistar+. The contracts have changed and the conditions too. One of the big changes of the last renewal was that the service was going to be delivered through League Pass.

This is positive for the user, as a Movistar+ user can access directly though League Pass and consume games and content through other channels: mobile, tablet… and not only the games shown by Movistar+.

In addition to it, Movistar+ broadcast in Spanish the games, and these Spanish broadcasting is offered to all users around the world. This benefit other Spanish speaking countries and the NBA that right now have not these capabilities.

LinkedIn says that in October 2022 NBA Spain has 38 employees, some of them working for Spain, some performing collaborations and some others focused on European activities.

Last but not least, the NBA can learn how many users access through the League pass directly, giving relevant data about their impact in Spain. The TV is the main source of users for the NBA in Spain, and there are many passive users that are just willing to consume what is in TV, not going beyond to that. But this could change.

Other capabilities

In Spain, there is a magazine called “Gigantes” and a podcast called “El Reverso”. They are popular content generators and they already have specific relationship with the NBA (I do not know the details of the relationship).

They add value to the NBA brand and they are an asset that I think that in future potentially will increase their relationship with NBA.

Questions that come to my mind:

- When will the NBA League will limit the contract with TV in Spain so they can give priority to League Pass?

- Will relevant assets as Gigantes or El Reverso being acquired by NBA?

- What is the gap of capabilities the NBA have to build to close the gap of users that are willing to watch NBA through the TV, but not pay a specific streaming service for a unique sport?

- Will they add advertisement or other ways to increase revenue? How are they going to build these capabilities?

In case NBA wants to run League Pass in Spain without the support of a TV company, they will have to build mainly two capabilities:

- TV production: in case they want to continue offering the broadcast in Spanish.

- Marketing & Advertisement: as today almost all effort is done by the current TV company.

Price of League Pass

The standard pack of NBA League started with a cost of $199, now it’s $99. This 2022-23 season they have decreased the price to make it more attractive to the users and increase their amount of subscriptions.

The prices in each country started to be quite different, for instance Australia standard service reached $300, and now with the ability of users to use VPNs the price is being offered at almost the same prices (without taking into account the taxes).

The changes of price every season is a good sensor of the pace of evolution of League Pass.

Questions that come to my mind:

- How many seasons will they continue decreasing the prices?

- When League Pass dominates the market share, will the NBA increase the prices?

Alternative initiatives

I found this initiative called BallerVision, promoted by Steve Ballmer (Los Angeles Clippers).

Closing

Did I miss anything? Constructive feedback is always welcomed!