After a good 2019 learning about how to trade, this 2020 was fine in so many ways, that I would like to review.

The math result? I did a 36%,

2020 started with $1.420,94

and ended with $1.934,41

so the P&L was $513,47 or a 36,1%

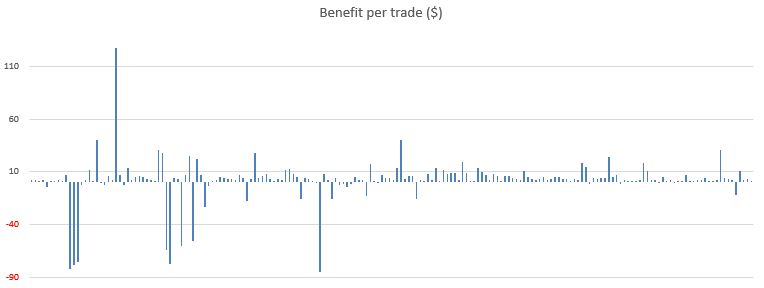

Total moves 188

wins 157 84%

loses 31 16%

This is the screen with the main data of win/loss events:

I have ordered by date of long move and the main major losses come from issues related to the crash happened in March.

I have ordered by date of long move and the main major losses come from issues related to the crash happened in March.

Some data

Best values I traded:

| Ticket | Gross Margin |

| VTVT | 126,98 |

| AEMD | 87,7 |

| PLTR | 64,96 |

| MRNA | 60,58 |

| CERT | 35,36 |

| MSFT | 31,78 |

| CVGW | 30,78 |

| ADMS | 25,22 |

| AAPL | 24,45 |

| TROW | 24,24 |

Worst values I traded:

| Ticket | Gross Margin |

| WBA | -226,74 |

| LYFT | -163,2 |

| UNM | -55,92 |

| SPG | -51,08 |

| GE | -25,38 |

| SRNE | -11,72 |

| MLND | -10,54 |

| DFFN | -8,04 |

| ONTX | -4,11 |

| ATNX | -1,02 |

The number of moves by month were:

| Month | # moves |

| Jan | 19 |

| Feb | 13 |

| Mar | 6 |

| May | 1 |

| Jun | 11 |

| Jul | 6 |

| Aug | 13 |

| Sep | 9 |

| Oct | 22 |

| Nov | 40 |

| Dec | 48 |

Portfolio data month by month

| Month | Started | Ended | Dif ($) | Dif (%) |

| Jan | 1420 | 1445 | 25 | 2% |

| Feb | 1445 | 1647 | 202 | 14% |

| Mar | 1647 | 1429 | -218 | -13% |

| May | 1429 | 1447 | 18 | 1% |

| Jun | 1447 | 1499 | 52 | 4% |

| Jul | 1499 | 1473 | -26 | -2% |

| Aug | 1473 | 1399 | -74 | -5% |

| Sep | 1399 | 1401 | 2 | 0% |

| Oct | 1401 | 1353 | -48 | -3% |

| Nov | 1353 | 1682 | 329 | 24% |

| Dec | 1682 | 1934 | 252 | 15% |

Some lessons from data:

- I have to stop loss better than I did, this happened to me in 2019 too.

- Portfolio management was better done in second half of the year and it gave me more consistent small wins.

- To pay attention to ex-date gave me a nice 47$ of dividends.

- The average of earnings have been 1,99$ in comparison with 2019 is worst (2,32%).

- 10% of the worst moves made me lose 705$ which is a lot.

- I have to improve on the way I’m trading, I still have some negative skew.

- The rally I did during the last 3 months enabled me to recuperate of a disaster. I have to focus myself on what I did well during Q4 because it worked.

- I have learned to read better the market timing indicators and this valuation has enabled me to exit and enter in values with better results.

Conclusions

- My 2019 trades were quite better than 2020 in so many ways: benefit, number of errors and bias.

- I have to concentrate more on the process and avoid the noise.

What to expect for 2021?

- I have increase the funds with 2000$, so we will start the year with 3934$.

- I will use the same percentage when opening positions: 1%, 2%, 3%.