Background

I have had some conversations about the maturity of the cryptocurrencies market related to the maturity of the companies and how I miss to have the fundamental indicators as you can have for a public company (Revenue, Costs, P/E, balance sheets…).

The companies publishing cyptocurrencies are private companies and they do not have obligation to share this information, but there should be in the future a general consensus about how to valuate their assets, the coins they put in the market.

As everybody can easily figure out, I always has stated that there will be a moment where so many cryptocurrencies will disappear as they do not make sense, and others will survive as they make sense and provide value.

Well, I would like to understand how to valuate them (better before they disappear).

Value… where? on the transaction.

The basis

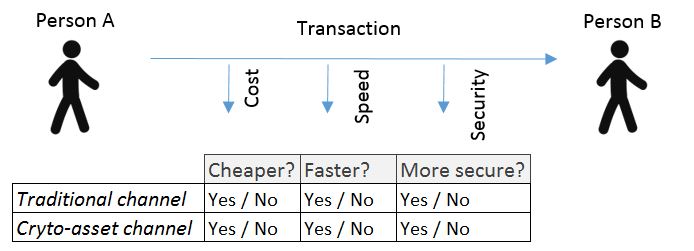

The basic value of a cryptoasset is the value provided to a given transaction. If you perform a transaction via the traditional or existing channel this has a cost, a speed of execution and a given security.

If you execute that transaction through a crytocurrency, is it cheaper? faster? more secure?…

On top of that, the volume of transaction:

- how many of these transactions are happening in the market?

- how many of these transactions are managed through this blockchain environment?

- What are the efforts of the company to attract more transactions to their ecosystem?

Cryptoasset Valuations

I’m a beginner on blockchain and on asset valuations, so I have look for the experts. I found this article written by Chris Burniske, where he explains how to do the valuation (he attaches a nice excel that helps a lot to understand the details).

Each cryptoasset serves as a currency in the protocol economy it supports. Since the equation of exchange is used to understand the flow of money needed to support an economy, it becomes a cornerstone to cryptoasset valuations.

The equation of exchange is MV = PQ, and when applied to crypto my interpretation is:

- M = size of the asset base.

- V = velocity of the asset (shows the number of times an asset changes hands in a given time period).

- P = price of the digital resource being provisioned (price of the cryptocurrency or crytoasset).

- Q = quantity of the digital resource being provisioned

A cryptoasset valuation is largely comprised of solving for M, where M = PQ / V. M is the size of the monetary base necessary to support a cryptoeconomy of size PQ, at velocity V.

Next steps

- I need to understand better the calculation of the market value.

- Go deep on a real ICO and perform a valuation.

- Understand how to do a token utility calculation.