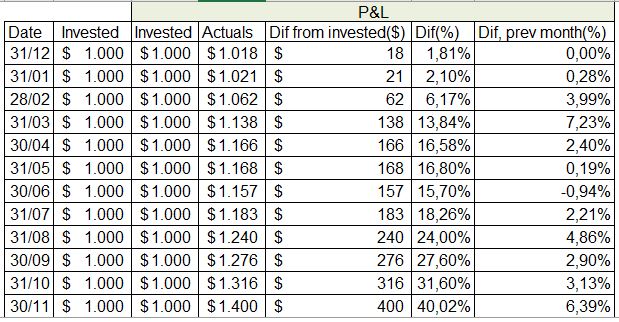

In 2018, I created a Robinhood account and I added 1000$. I had a goal, it was to trade with that money, and learn about how to trade in a systematic way and understand how the environment was going on.

I started slowly, with few amount of moves, practicing on stocks I knew and using the learning I acquired trading with crypto-currencies (year 1).

As the money was limited, I divided the trades in 4 units, so every long event should be around 250$. My initial goal was to obtain a 6% growth through 2019.

I did not want to limit myself to a goal number, as the market would have a direction that I cannot control in 12 months, but I wanted to set a reference and initially it was 6%, then I moved to 10%, then I moved to 25%.

The math result? I did a 40%

This final result was an unexpected result, I started doing individual moves and learning from my previous experience, understanding the SPX behavior and trying to learn from the results. Initially I was psychologically stressed with the situation, but I learned how to handle it and the results started to be positive once I keep the actions aligned to my convictions.

The learning result?

I have learned a lot of things, as in the middle of the process I had no money to trade, or I had problems to be with time in front of the computer, or there were times where the market was not in the conditions I defined to trade. Some of the things I learned:

- To be as much systematic as possible:

- defining a set of environmental factors that I checked before to trade.

- I have defined a set of companies that I use for trading, depending on different conditions.

- I have been able (not 100% of times) to close the computer and read a book when the conditions where not the right ones.

- I started to be more systematic after reading Systematic trading 🙂

- Analysis:

- Analysis of companies, about how they generate cash-flow, in which part of the cycle they are, etc.

- I learned how to follow trends (differentiate when market is pushing or is moved by inertia).

- I learned to focus on quote ranges, not on trends. There is a space where the market is moving, I have tried to focus on that range of realistic moves, focusing on small trades.

- Act aligned to my convictions, and recognize that I have to be flexible about convictions:

- I have learned a lot about how bad I am about this. I need to improve a lot if I really want to be successful. To trade with 1000$ is nuts, and when the number will increase I have to be more mature on this area. Let’s say that I am more aware of my problem with early shorts that could gave me bigger returns.

- I learned that I am mainly a negative skew trader. The good thing is that now I’m aware of that and I’m adding some actions on my habit at the time of adding stop-loss actions.

- I have to improve better to short on loses before the lose is too high. I have earned an average of 2,32$ per trade, if I remove the 10% of biggest loses I would have obtained an average of 3,78% which is a lot.

- The thesis I have done have changed with respect the environmental conditions that have been happening. I have used the China-US trade news, brexit, Brent price and euro/dollar exchange as variables to modify my thesis and market behavior.

- You are managing a portfolio of money, and you have to be consequent with the limits of resources:

- Sometimes I had no money to trade, when the market was in the best moment to short.

- I learned to anticipate to the best moments and short some moves with the purpose of doing small margins but have cash for next days.

- During the last 2 months I was able to do 5 units, as I was over 1200$, so I could trade a little bit more.

Analysis of data

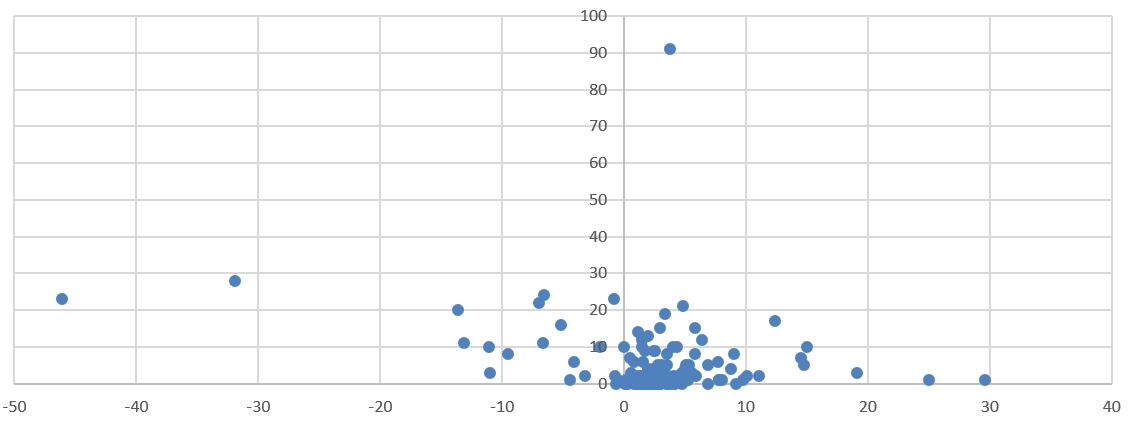

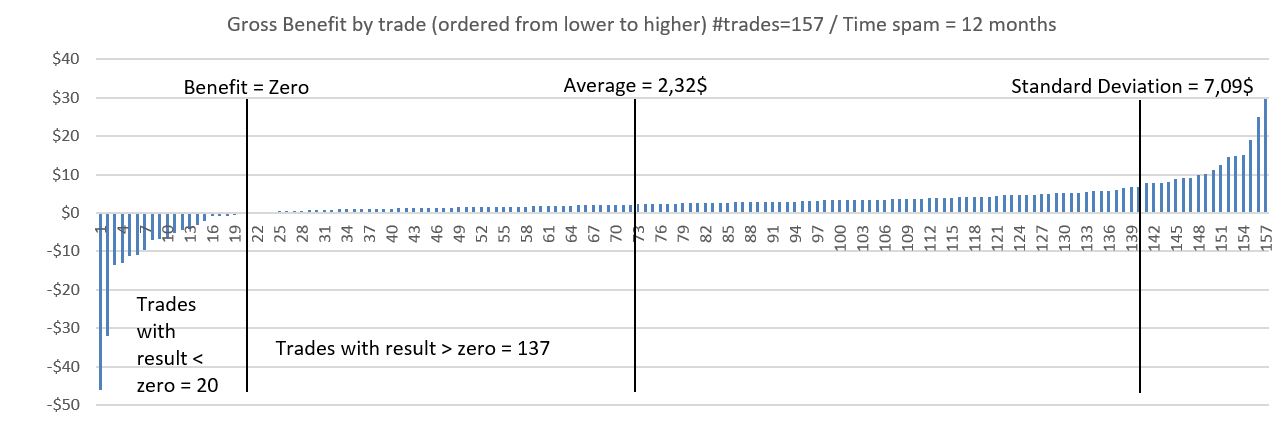

I have done 157 trades during these 12 months.

I have done 157 trades during these 12 months.

- 20 trades were below zero (loses), 137 were over zero (gains).

- The worst 10% of the trades supposed me to lose 173$. If I would have stopped these loses before I would have earned more. I have to take into account too that the use of stop-loss in the wrong way would have made me to lose some margin on trades that I have finally be over zero.

- Using pareto principle (six sigma), where solving 20% of the issues you can solve 80% of the consequences, I have added to my habits:

- Stop losses in a controlled way: do not let the loses to be over the defined range.

- Use stop loss actions to sell, and in this way not stop the positive trend of a stock.

- Divide the money in 2 for the longs, so in case of a small negative trend, I use the second part of the money and I reduce the average cost.

- Using pareto principle (six sigma), where solving 20% of the issues you can solve 80% of the consequences, I have added to my habits:

- The average of the earnings have been 2,32$.

- Without the 10% of the worst trades the average would have been 3,78%.

- Without the 10% of the best trades the average would have been 1,1%. This is interesting, because reviewing some of the trades, I have realized that I’m not trading with negative skew the 100% of the times. I have progressed to a more positive skew habits.

Distribution of the trades depending on the days that took to open and close a trade:

| Company | Gross marging |

| GE | $78,08 |

| CRM | $38,50 |

| CTVA | $32,17 |

| BA | $28,74 |

| TXN | $28,10 |

| MSFT | $25,54 |

| INTC | $23,33 |

| GIS | $19,05 |

| GMRE | $18,68 |

| WDAY | $18,66 |

Worst values I traded:

| Company | Gross margin |

| PTC | $2,02 |

| DUK | $1,51 |

| WELL | $1,50 |

| CELG | $0,93 |

| XOM | $0,88 |

| T | -$1,52 |

| KO | -$6,54 |

| JNJ | -$7,82 |

| MMM | -$8,67 |

| DWDP | -$46,08 |