Context

New hype shows up, then capital values the opportunities and frantically they invest and invest. Suddenly the investors reach the time where the company promised returns, and many of them cannot provide it.

This phenomenon happens a lot, now with everything that has “AI”. But it is not unique to the AI world, it is something that happens since the Catholic Kings (venture capital) gave funds to Cristobal Colon start up which promised a faster route to arrive to India.

The investment cycles have been decreasing and decreasing through centuries, in the last 15 – 20 years this investment cycles are decreasing faster: more money available, better software, etc.

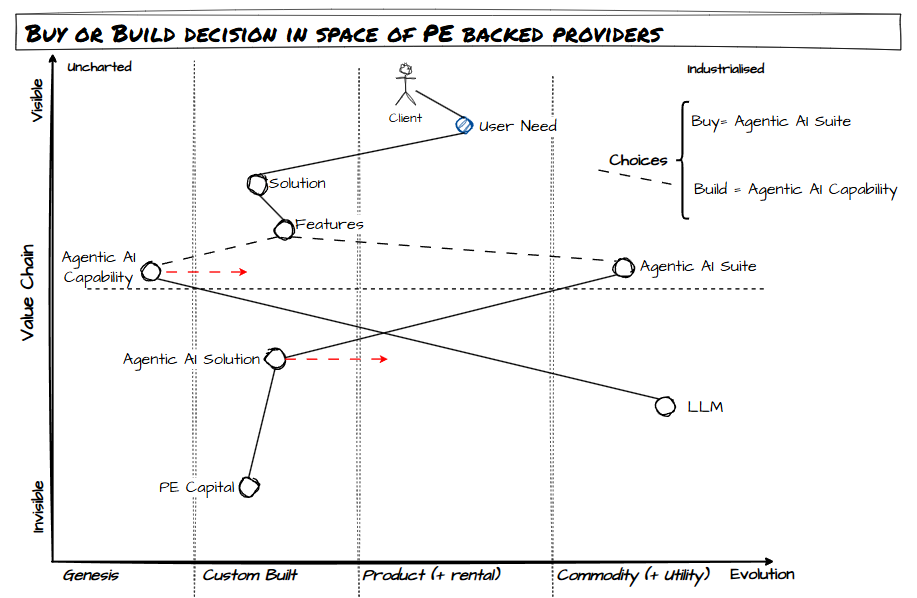

A new capability appears, what do you do? buy or build?

I will use the example of Agentic AI, that is a hot topic now. You identify the presence of Agentic AI solutions are seen as a valued differentiator, and you do not want to be seen as not been in the leading edge.

What do you do? buy or build this capability?

Some companies invest in building their own capabilities, being patient and taking the risk of failure while implementing it.

Other companies consume a service and delegate the capability to an external provider that is highly capitalized by PE. The risk they assume is that the provider does not survive, or that in future the prices of the provider go up.

How do you face this dilemma in your context?

There are many ways to solve this situation, and it’s not something you have to be able to do once, it’s something you have to do from time to time.

Oversimplifying the situation, to me there are 2 vias to solve this dilemma, and it depends if your company DNA has technology in it or not.

Technology is in your company DNA.

I will discard the intermediate tool. You do not want that dependency.

I would build components directly against commodity LLMs, vector databases, etc…, trying to do it on Open Source frameworks (the ones that in the long run will probably).

These solutions force you to validate what use cases really provide real returns to the organization. Probably you will have to send to the trash some of them, that’s part of the cost of being in business.

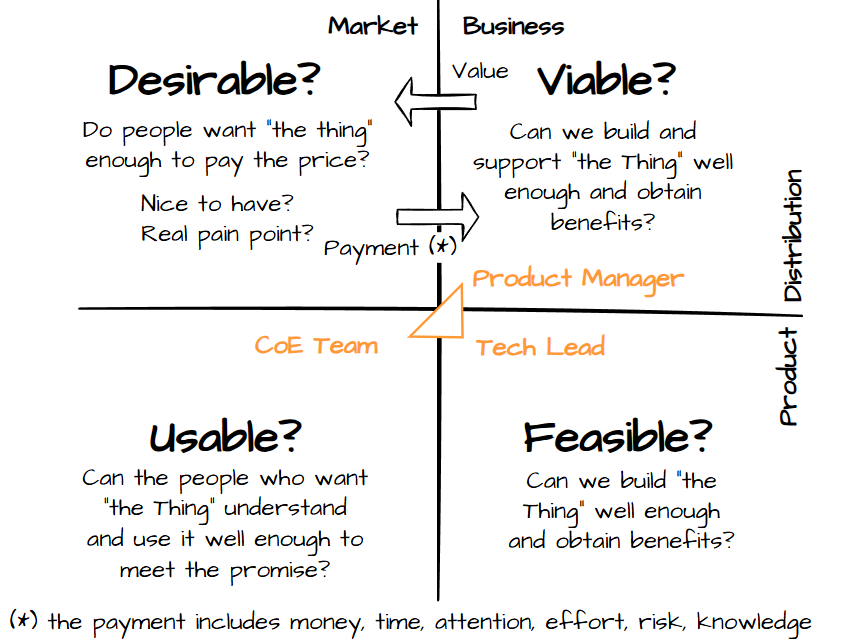

But as you know, to find use cases that provides enough value (ROI) is not easy. Consuming third party tools when we are still in a emergent space is not a good idea. It’s a hard process to understand what things are desirable, viable, usable and feasible, but you have technology in your DNA, so it’s your natural space.

There is the intangible and relevant asset in the equation: the knowledge your company is gaining with it.

One of the more important things you learn is how to integrate these new technologies within all you already have. You know you cannot ignore all you have built and to work at low level enables you to have better interdependencies and discover soon the challenges of integrating these new technologies.

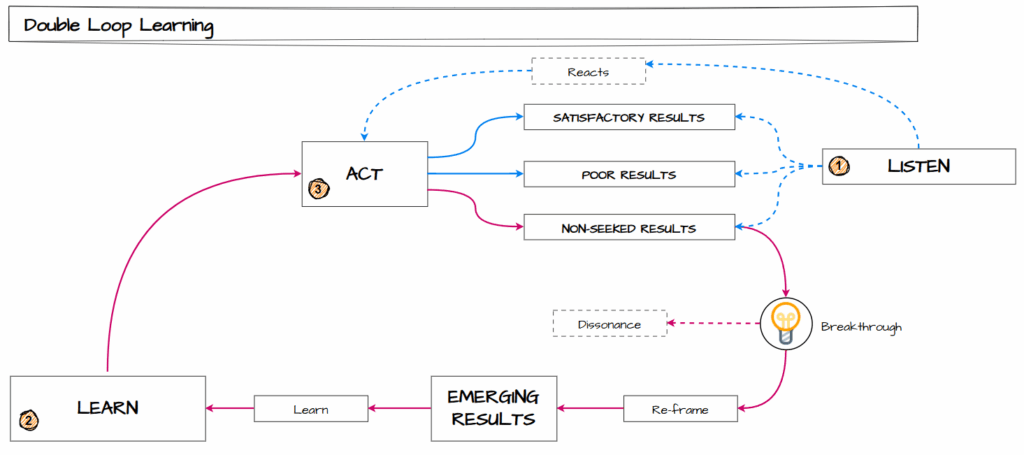

I would also build the mechanisms to have the ability to swap out underlying provider (in this case the LLMs providers). Why? because they will also be pressured by the market competition and you potentially will face price increases or the existence of having better alternatives.

Technology is not in your company DNA.

Don’t panic. It’s a hype, wait till the dominant players show up.

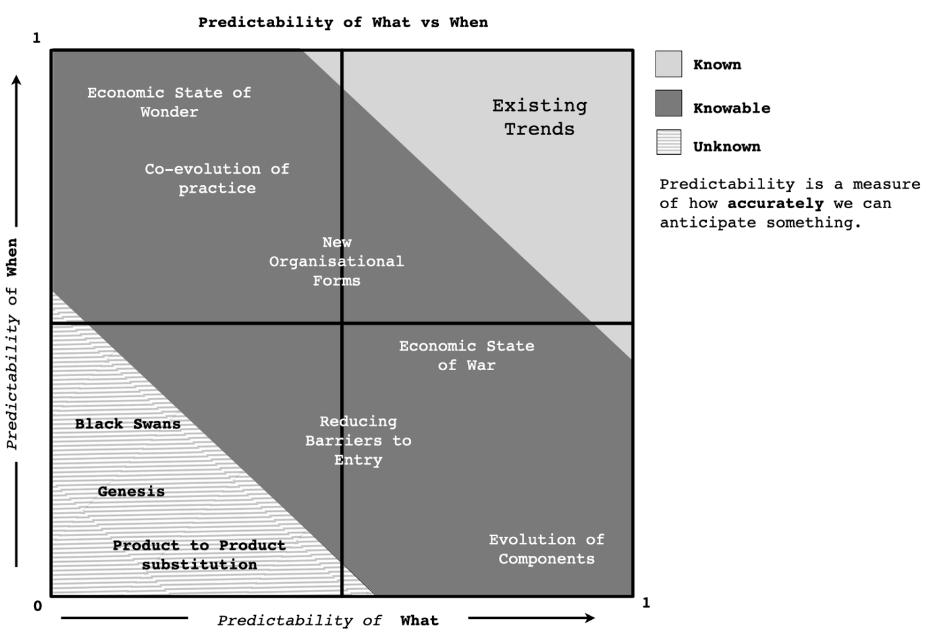

There is a lot of anxiety with all hypes, and this is not an exception. The point is that in this wild context, many of the emergent companies will die, so many others will be acquired and in some years we will have some players that will play the game in the commodity space.

I would be patient and wait to enter in the space. What is the right timing? Difficult to know. Here is better to pay attention to the practices that emerge as best practices and see what vendors implement these practices better. There will be a moment where everybody will offer more technical capabilities than you need, so to identify what is the best choice is going to be difficult just looking at technology. Look at the co-evolution of practice, new organizational forms, evolution of components…

Other important factor: protect your data. Your business contains a lot of relevant data, there are companies offering discount prices to solutions that pull your data.

Last but not least, integration. To effectively obtain benefits from these investments you need to integrate these solutions properly. This is not easy and it requires knowledge and best practices. If you use them in their genesis, you will not know what are the best practices (as they do not exist). It takes time to discover what are the practices that mature and are adopted by the majority.

Trends are just that: trends, later they go to a secondary plane

The blockchain hype was huge some years ago, and I admit that the AI explosion is a different animal, but in any case you need to admit you are not a technology company, focus on your business and understand the right timing to consume certain technologies.

Cloud, blockchain, crypto, web, mobile, digital transformations… all trends.

What happened before 2010?

To me before 2010 the cycles of innovation were longer and the activities of Private Equities were relevant, but not with the hype we are living since 2019.

I have read a lot that Private Equity is in a bubble. I do not know if this is true or false, only time will confirm it. But the fact that the speed of innovation is faster, the capital injections are bigger and the expected results are claimed in less periods of investment seem to be real.

The volume of excessive capital in the market, especially in US is an external factor that cannot be ignored.

Takeaways

For every case there is an individual solution, define your situation as best as possible, understand how you play the game at this space and make a decision when it makes sense for you. All this sounds easy, but it’s not, so good luck.