Today, in the Payments Innovation Conference this morning done in the Federal Reserve (from now on “Fed”) something relevant has been announced.

WASHINGTON, Oct 21 (Reuters) – The U.S. Federal Reserve is studying the creation of a new account that would provide access to Fed payment services for firms that currently rely on third parties like banks for that access, a senior official said on Tuesday.

Fed Governor Christopher Waller said the so-called “payment account” is a prototype idea that could grant access to firms seeking to utilize the Fed for payment services, without granting them full access to the services and backstops the Fed provides to banks.

what does it mean?

Let’s provide some context

The Fed has a set of mechanism to put in circulation the money they “generate”. These mechanisms are:

- Fedwire Funds Service (Fedwire): A real-time gross settlement (RTGS) system primarily used for large-value, time-critical payments, such as bank-to-bank transfers and final settlement of financial transactions. Payments are immediate and irrevocable.

- FedACH Services: The Fed’s operator for the Automated Clearing House (ACH) network. This is a batch-processing system used for a high volume of low-value electronic payments, such as direct deposit payroll, bill payments, and consumer transactions. Transfers typically settle on a delayed schedule (e.g., next-day, or same-day options).

- FedNow Service: A newer instant payment system launched in July 2023. It provides financial institutions the infrastructure to send and receive payments 24/7/365 with immediate clearing and settlement.

Who can use these services?

Short answer: american banks. These bank request a “Master Account” and once approved, they can be subjected to use them in their channels.

As an example of some of them (not all included).

| Institution Type | Fedwire Funds Service (Large-Value) | FedACH Services (High-Volume) | FedNow Service (Instant Payments) |

| Global Banks | JPMorgan Chase & Co. Bank of America | Wells Fargo Bank, N.A. JPMorgan Chase & Co. | JPMorgan Chase & Co. Wells Fargo Bank, N.A. |

| Custody Banks | The Bank of New York Mellon (BNY Mellon) State Street Bank and Trust | N/A | The Bank of New York Mellon (BNY Mellon) |

| Investment Banks | Goldman Sachs Bank USA Morgan Stanley Bank | N/A | N/A |

| Regional/Community Banks | U.S. Bank, N.A. Capital One, N.A. | Bank of America PNC Bank Truist Bank | U.S. Bank, N.A. Avidia Bank Ameris Bank |

| Credit Unions | N/A | Navy Federal Credit Union Pentagon Federal Credit Union (PenFed) | Corporate America Credit Union Addition Financial Credit Union |

| Payment Companies / FinTech | N/A | Adyen (as a bank partner) Discover Bank | Adyen N.V. BancFirst |

What is the problem them?

This makes that new financial institutions have been requesting a Master Accounts and they have been rejected, delayed or put on-hold.

For instance:

| Company Name | Type/Industry | Status Summary | Reserve Bank |

| Custodia Bank, Inc. | Crypto/Wyoming SPDI | Denied (Jan 2023) and is currently in litigation with the Fed. | Kansas City |

| The Narrow Bank (TNB) | “Narrow Bank” Model | Denied (Feb 2024). | New York |

| PayServices Bank | Payments/Idaho Bank | Denied. | San Francisco |

| Anchorage Digital Bank N.A. | Crypto/National Bank | Pending (Tier 3 review, applied 2025). | Minneapolis |

| BCUS, Inc. (Banking Circle US) | Payments/FinTech | Pending (Tier 3 review, applied 2019, one of the longest-pending applications). | New York |

| Ripple | Crypto/Blockchain | Reported to have applied via a partner (Standard Custody) or for a charter with the goal of Fed access. | N/A |

| Circle | Stablecoin Issuer | Reported to be applying for a charter with the goal of Fed access. | N/A |

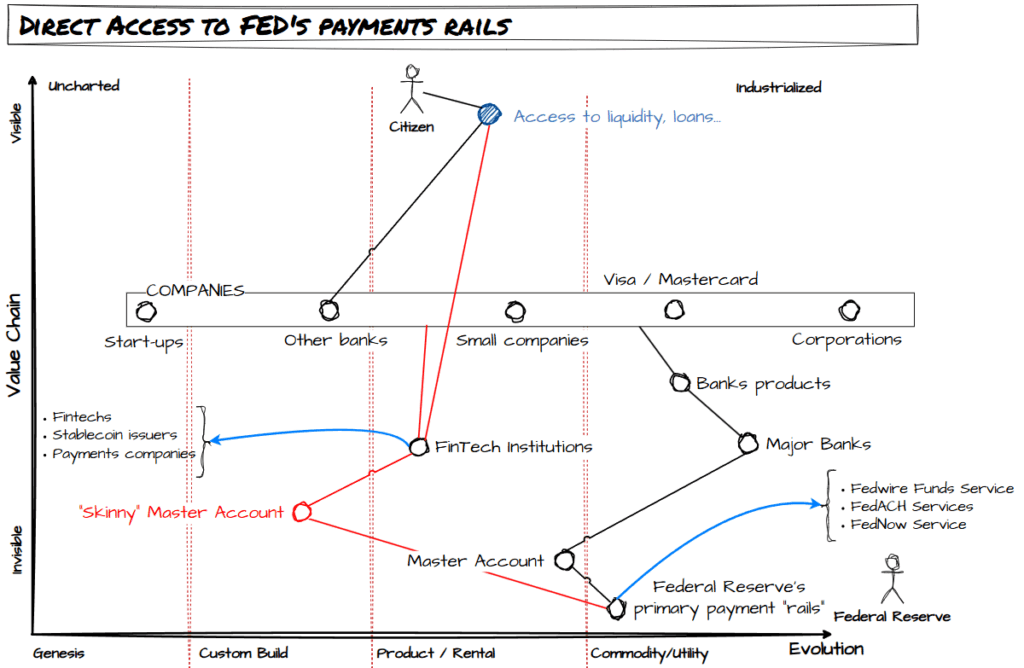

A map about this landscape

Master Accounts enable a limited number of institutions to provide and make profits with the distribution of liquidity provided by the Fed.

In red the new channels that this announcement will be enabling (remember, right now this is an announcement, they need to approve it and execute it).

This will have many unknown consequences in many aspects, and it makes me think about many questions:

- Liquidity can be directly go from Fed to consumers; will Fintech directly use this liquidity to offer B2C products?

- Major banks moat is cracking; how are they going to adapt?

- What are the differences between a master account and a “skinny” master account?

- Fed recognizes the paper of these FinTech institutions in the market as major players.

- Visa and Mastercard have not access to master accounts, will they request now one of these new accounts?