I have not an answer for that question, but when you look at the history and see things with perspective of time you can understand some reasons to do it.

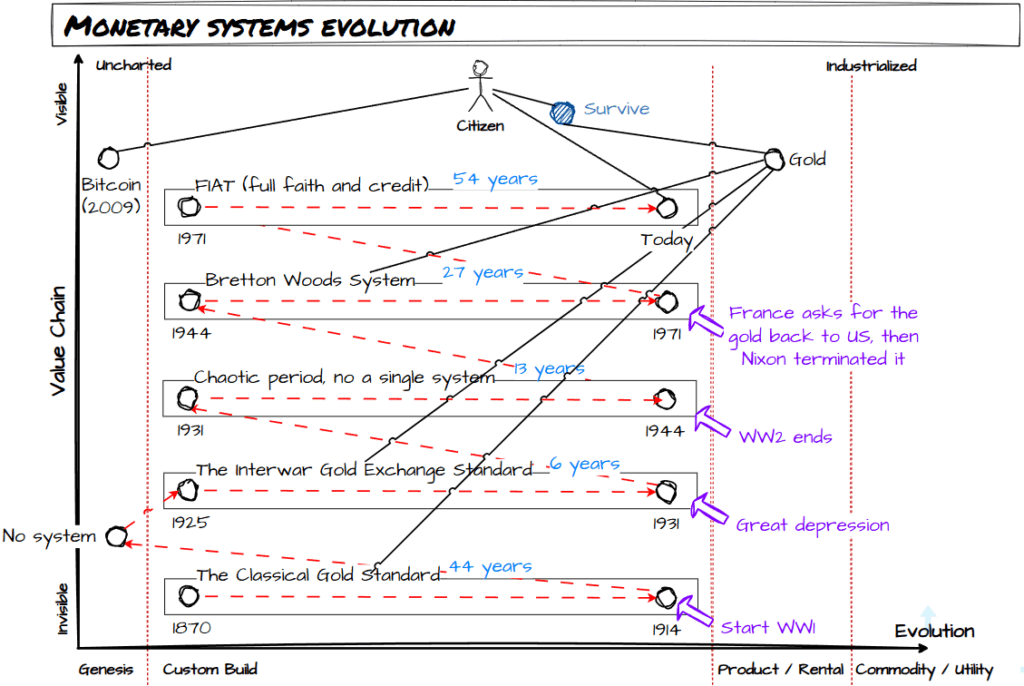

I build a map with my understanding of the scenario we have lived during last 250 years.

We have had different monetary systems, where gold has been the reference in many of them.

These systems were abandoned due to certain events (mainly major wars and depression), and then a new prevalent system emerges.

- Classical gold standard is considered by many as the first global monetary system, a period where England was an empire.

- First WW made to have a period where no prevalent system was accepted internationally.

- The Interwar Gold Exchange Standard: there were an attempted return to Gold standard, but it did not mature well and the great depression made the countries to focus on their own critical problems.

- The chaotic period (1931 – 1944) was full of devaluations, WW2….

- After WW2, US took the lead and imposed a gold-USD standard: Bretton Woods.

- FIAT system started when Valéry Giscard d’Estaing (Finance Minister for France under Charles De Gaulle) started to ask for the gold US had borrowed. Once other countries started to replicate the same ask Nixon decided to abandon the gold-USD system (Bretton Woods).

The name fiat comes directly from the Latin word “fiat,” which means:”Let it be done”, “By decree” or “an authoritative order.”

In the context of monetary systems, it highlights that the money’s value is established by a government’s command or official decree, rather than being based on the intrinsic value of a physical commodity like gold. Right now the fiat decree is based on the fact that the reference is the US Dollar.

Many questions you can ask yourself about the problems the current system has, what would be the event that will break the current global agreement, how does the next system or reference of value will be…