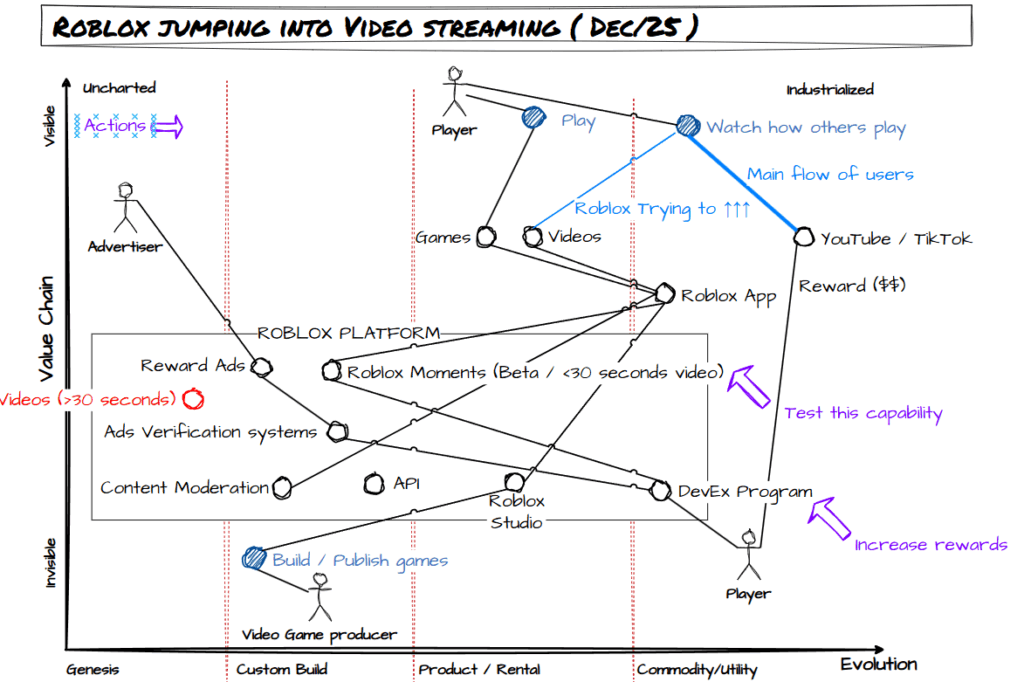

Reading some news about the evolution of Roblox, I discovered they has developed the ability to:

- produce and use videos shorter than 30 seconds,

- incorporate the ability to manage ads (agreement with Google),

- incorporate the ability to validate ads (agreement with Google).

Long story short: they are exploring how to monetize and incorporate videos into their platform.

It would be interesting to understand how Google profits from this.

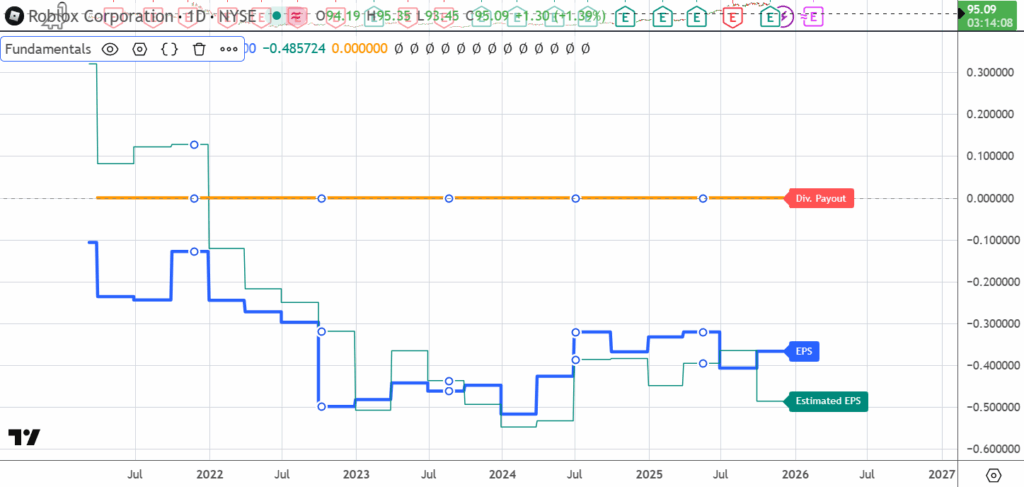

When looking at the P&L of the company, there are two things that took my attention:

- They are still providing negative Earn per share (they have negative EBITDA)

- The increase of gross margin is in parallel with the Operational Expenditures (they continue investing aggressively).

Looking into equity, debt and cash available, they seem to have enough cash to continue with the growth strategy they are executing.

EPS evolution looks like this:

Some of the main head winds I see on Roblox are:

- Child Safety and Legal/Regulatory Scrutiny: The platform faces significant expenses in legal lawsuits.

- EPS still negative: they are not able to stabilize the operational expenses.

- Their customers grow up: there’s an age where the clients jump into another platform. They are able to keep the under 13 playing, they have a lot of problems of attraction and retention between 13-17.

- Content is generated manually, so this increases the need to pay the creators, increasing the expenses.

There are some climatic patterns or external factors that are helping Roblox (at least in my view):

- The acceptance of gaming continue growing, and the grownups more and more accepts social interaction of their children through gaming.

- The creator community continues growing. This is important for them as they have a User-Generated Content (UGC) model. The increase of revenue seems to be the direction to make EPS positive.

- Growth in Advertising and Brand Partnerships: there’s a lot of space for Roblox to growth in this area, the exploration done with “Moments” indicates their conviction on it.

They are not alone in the competition of the attention of young players:

- Epic Games

- Microsoft

- Meta

- Unity

continue capturing a lot of users.

Roblox has not announced a date where they expect or commit to have positive EPS. The analyst consensus (which is a very weak statement, I know) is that they will do it between 2027 and 2028. Seeing the model they have (manual content generation) which constraint their ability to limit the expenses, and the use of Ads (that has a long term impact but not short term), it seems that the increase of revenue is the direction of the company towards a positive EPS.

Any issue in the revenue growth will have a strong impact on the price of the stock.