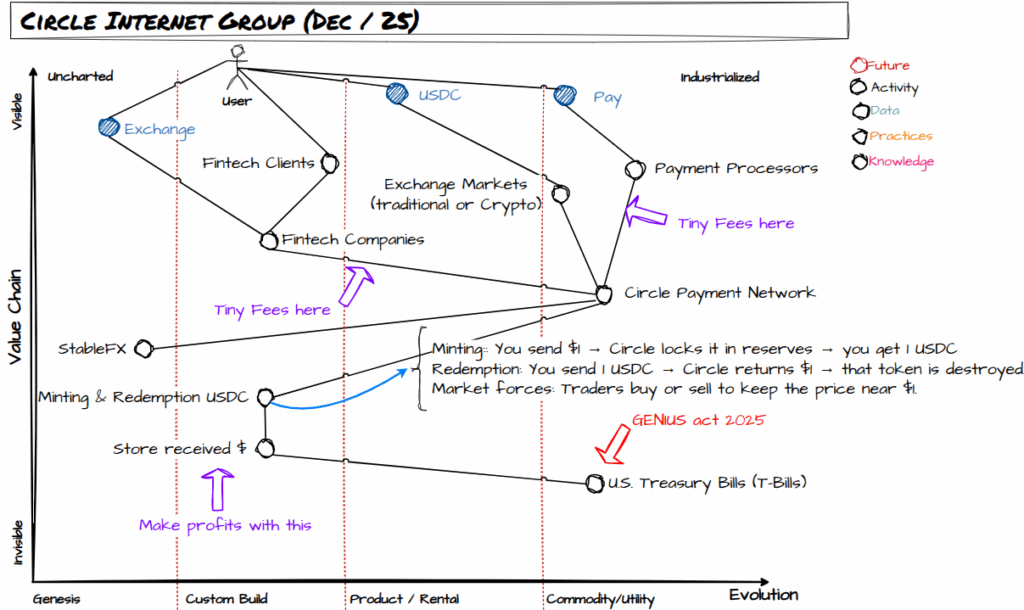

I have been reading more about stablecoins and what are the mechanisms behind the scene.

In this previous map I asked my question: what do these companies do with all these US dollars they have in custody?

The answer before July 2025 was: where they obtain more benefits keeping the risk of lack of liquidity under control.

But this changed in July 2025 with the US passed the Genius Act, which legally mandates that “payment stablecoins” must be backed 1:1 by highly liquid assets. This includes cash and Treasuries with maturities of 90 days or less.

At this moment, the end of 2025, Stablecoin issuers collectively hold hundreds of billions of dollars in U.S. Treasuries and it’s increasing as new players (for instance Visa) are adding their services to the party , placing them among the top 15-20 holders of U.S. debt globally—surpassing many sovereign nations.

When the U.S. government pays interest on its bonds (e.g., 4–5%), that interest usually goes to the Stablecoin issuer (for instance Circle), not the token holder.

Any interest payment has a linked risk. The link between the Stablecoin and the U.S. Bonds creates a “feedback loop” that probably concerns the Fed:

- The Run: If people lose confidence in a Stablecoin, they rush to redeem it for cash.

- The Fire Sale: The issuer must suddenly sell billions of dollars in U.S. Bonds to meet those redemptions.

- Market Stress: If the sale is large enough (e.g., $50B+ in a day), it can cause the price of U.S. Bonds to drop and interest rates to spike, affecting the broader U.S. economy.

There are many ways to access to these U.S. bonds, the easy way is through an ETF.

| Ticker | Fund Name | Focus Maturity |

| SGOV | iShares 0-3 Month Treasury Bond ETF | 0–90 Days |

| BIL | SPDR Bloomberg 1-3 Month T-Bill ETF | 30–90 Days |

| TBLL | Invesco Short Term Treasury ETF | 0–12 Months (Heavy 0-3m weight) |

| CLTL | Invesco Treasury Collateral ETF | Ultra-short (0–12 Months) |

| USFR | WisdomTree Floating Rate Treasury Fund | Floating rate (Reset weekly/monthly) |

| TFLO | iShares Floating Rate Treasury Bond ETF | Floating rate (Reset weekly/monthly) |

Today (18/Dec), the table of interest is as follows:

| Maturity | Yield (Annualized) |

| 4-Week (1-Month) | 3.76% |

| 13-Week (3-Month) | 3.64% |

| 26-Week (6-Month) | 3.60% |

| 52-Week (1-Year) | 3.51% |

I updated the Wardley Map with that new component that is much relevant.