I was not familiar with this ecosystem of payments and I wanted to learn a little bit on the basis.

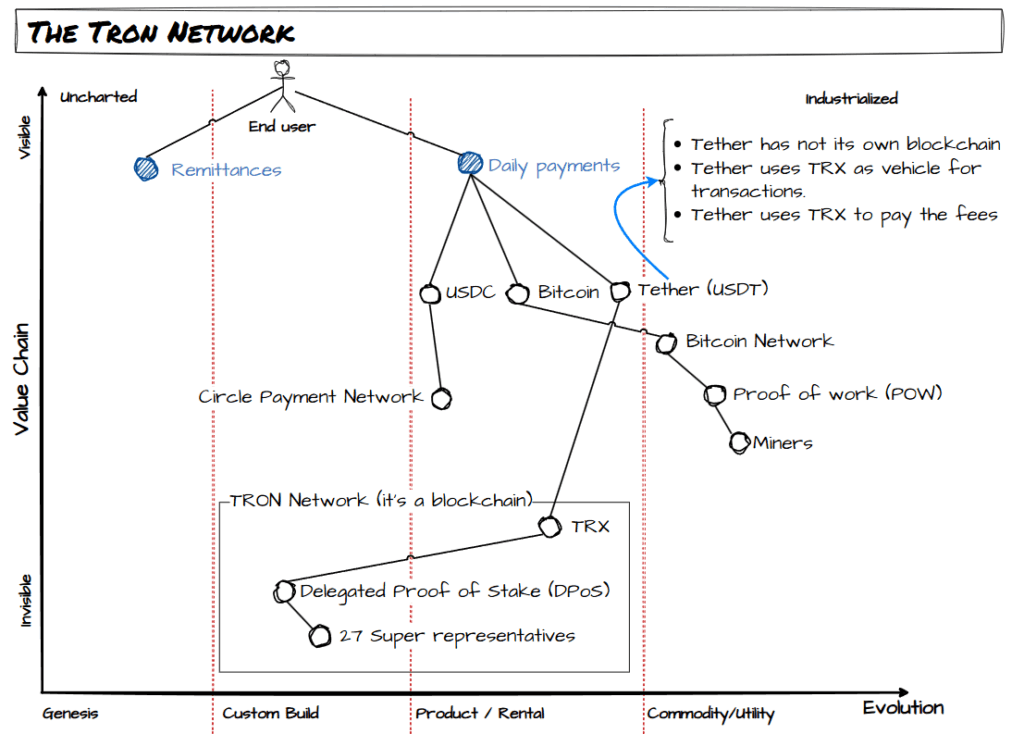

The TRON Network is a decentralized, open-source blockchain designed to be a “global settlement layer” for digital assets.

They started in 2017 with the goal of decentralizing the internet and the entertainment industry (giving content creators direct control over their work), but they found out that was more interesting to evolve into a network for stablecoin transactions.

Right now they are the leaders of this segment:

Comparison of Usage Metrics (approx. January 15, 2026)

| Metric | Tether (USDT) | USD Coin (USDC) |

| Market Capitalization | ~$187 Billion | ~$75 Billion |

| 24h Trading Volume | $70 – $90 Billion | $10 – $20 Billion |

| Primary Ecosystem | Global exchanges (Binance, OKX), TRON network | DeFi, US-regulated institutions, Solana/Ethereum |

| Market Share | ~64% of stablecoin market | ~25% of stablecoin market |

Where are they now in beginning of 2026?

TRON Network is the primary home for Tether (USDT). Why?? basically because it is much cheaper and faster than the Ethereum network, it has become the standard for:

- Daily Payments: Used heavily in emerging markets (Asia, Africa, and Latin America) for daily commerce.

- Remittances: Sending money across borders with fees that are often less than $1.

- Settlement: As of early 2026, TRON processes over $20 billion in daily stablecoin volume, often surpassing the settlement volume of traditional payment processors like Visa on certain days.

How does Tron Network operate?

TRON uses Delegated Proof of Stake (DPoS). Instead of “miners” (like Bitcoin), the network is secured by 27 Super Representatives (SRs).

- Speed: It can handle approximately 2,000 transactions per second (TPS), whereas Ethereum handles roughly 15–30 (the difference is ridiculus).

- Energy & Bandwidth: Unlike other chains where you always pay a gas fee in the native token, TRON Network users can “freeze” (stake) their TRX to earn Bandwidth and Energy. This allows them to perform a certain number of transactions every day for free.

- Compatibility: TRON is compatible with the Ethereum Virtual Machine (EVM), so developers can easily move apps from Ethereum to TRON.

- TRX is the native currency of the network.

- TRK has different uses:

- Governance: Staking TRX to vote for the Super Representatives who run the network.

- Resource Generation: Staking TRX to get “Energy” and “Bandwidth” to avoid transaction fees.

- Deflationary Model: TRON regularly “burns” TRX used in transaction fees. This has made TRX one of the few major cryptocurrencies with a consistently deflating supply.

Who are the 27 Super Representatives?

The 27 Super Representatives (SRs) are elected by the community every six hours. Because this is a dynamic election, the list changes frequently based on voter support and reward distribution (brokerage rates).

As of January 2026, the top 27 are:

Major Exchanges & Institutions

- 1. Google Cloud (Joined in 2024, now a top-tier validator)

- 2. Binance Staking

- 3. HTX (formerly Huobi)

- 4. OKX

- 5. Bitget

- 6. P2P.org (Professional institutional validator)

- 7. Bitrue

- 8. Poloniex

Professional Infrastructure & Nodes

- 9. TRON DAO (The foundation’s official node)

- 10. LUGANODES

- 11. Ankr

- 12. Staked

- 13. CryptoChain

- 14. Allnodes

- 15. JD Investment

- 16. Tronics (Community-run node)

Regional & Ecosystem Partners

- 17. Justin Sun (Personal official node of the Tron Network founder)

- 18. TRON Society

- 19. Skypeople

- 20. Infinity Stones

- 21. Staking.Store

- 22. HashQuark

- 23. ChainDream

- 24. Bitguild

- 25. Ellipal

- 26. Trust Node

- 27. Compound-Node

Why the List Changes

The rankings are determined by TRON Power (staked TRX). If an SR lowers the percentage of rewards they share with voters (their “Brokerage”), users often move their votes to a different candidate, causing that SR to drop out of the top 27. The candidates are classified as partners.

- Super Representatives (1–27): Earn block rewards and have voting rights on network governance.

- SR Partners (28–127): Do not produce blocks but still earn “voting rewards” based on the number of votes they receive.

You can see the list here tronscan.org/#/sr/votes

how the dependency between USDT and TRX happens?

- Tether has not its own blockchain

- Tether uses TRX as vehicle for transactions.

- Tether uses TRX to pay the fees

Deflationary Pressure

Because of the massive volume of USDT transfers, a huge amount of TRX is “burned” every day by users who don’t stake.

- In 2025 and early 2026, TRON has consistently burned more TRX than it creates.

- This means USDT usage is the primary reason TRX is a deflationary currency. The more people use USDT, the rarer TRX becomes, which theoretically supports its price.