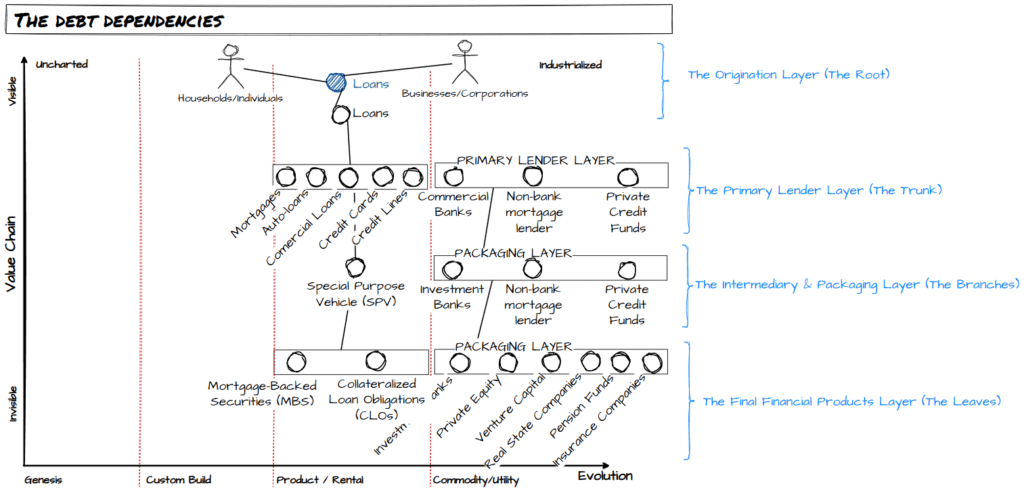

Listening the this episode of Kapital’s podcast titled “Too big to bail” (it’s in Spanish), I took my time to draw some of the dependencies commented there.

It’s interesting to see how capital flows move from one place to other.

After 2008, the commercial banks saw how the regulation limited their ability to get loans from users. Private Credit funds saw a need and started to buy these loans to the commercial banks and protect themselves through insurance policies.

- Are we at risk of repeating 2008?

- What is the weakest link in this debt chain?

This gave me the idea of understanding the dependencies between different layers of debt tenants.

The “tree” of debt tenants is huge and diverse, take this as an over simplification.