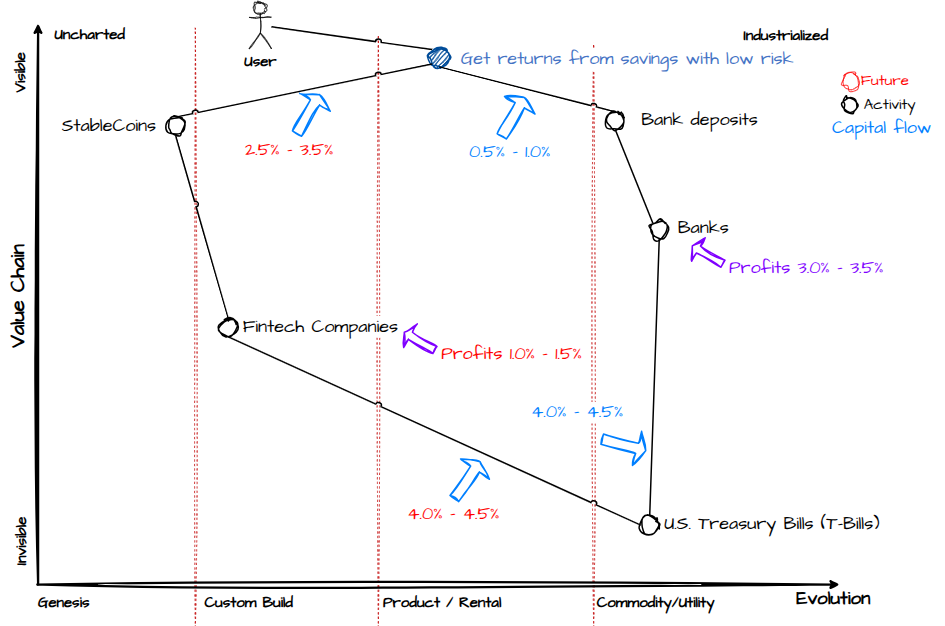

The yield / no-yield discussion around Digital Asset Market Clarity Act exposes this tension (map below):

In one side, banks keep high volumes of deposits and provide less benefits to the end user. In the other side of the table Fin-tech companies are willing to offer more profit to users for the adoption of Stable-coins, and accept less profits.

Genius Act forces the organizations offering Stable-coins to have the liquidity of these assets available in less than 90 days. This makes that the U.S. Treasury Bills below 90 days are a perfect fit for these organizations to make some profit of the stored US dollars.

Not all these amount of money goes to the US treasury bills, they diversify investments in many different vehicles, but high volumes go to to these treasuries due to lower risk.

Today, in addition to that, Tether announced the launch of USA₮, basically their “Federally Regulated, Dollar-Backed Stable-coin”, to take part of the pie.

Some big questions around this:

- What would be the impact of the final decision on this Clarity Act?

- Will be the Fin-tech capped with a limited amount of yield?

- Is the US dollar going to be affected by this more?

Another map with my perception of the sovereign debt.