Background

We are working on a contract renewal with a customer that is driving the process with clear goals and expectations. They want to renew just for 2 years and have a YoY savings of 6%.

Initial approach

We were requested to look into the current solutions, look for improvements and identify transition or transformation projects that enable a new contract with the 6% savings.

We have done the analysis and after that we have done some specific conclusions and a generic conclusion about the situation.

What is the typical cycle of CAPEX investment where you are looking for ROI?

- 5 Years contract.

- Transition & transformations during the first 2 years.

- Positive return in the fith year.

- Consider basic calculation/benefits, I have not added any additional benefit as time to market, or other benefits.

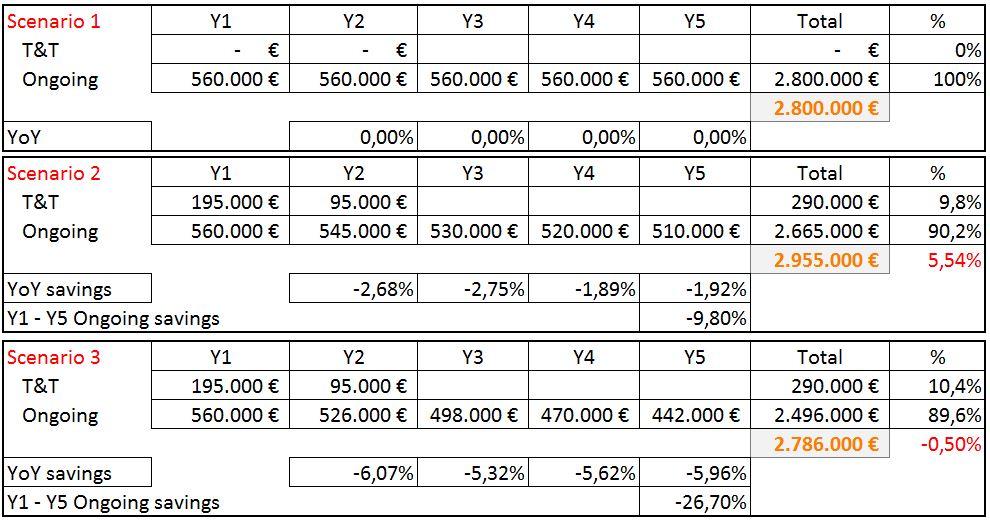

In my analysis I have created simple scenarios:

- Scenario 1: plain scenario, as baseline for comparison (I do not do anything).

- Scenario 2: T&T with 10% on 5 years contract with small YoY reduction.

- Scenario 3: T&T with 10% on 5 years contract with a more agressive YoY reduction.

Conclusion

Conclusion

- When creating T&T programs with specific returns, you require some time to

- T&T should not be more than 10% – 12% of the overall price of your solution.

- In environments where automation is deployed and there are not other major angles to improve, a different approach is required (change of solution with a business case that requires more CAPEX and years to obtain ROI).

- Hidden cost is an obstacle to be competitive.

- In our case, it is mathematically not possible to propose a T&T project to recover the ROI is just 2 years (if you are not removing a clear major issue). The only available approach is to accelerate continuous improvement on the existing services.