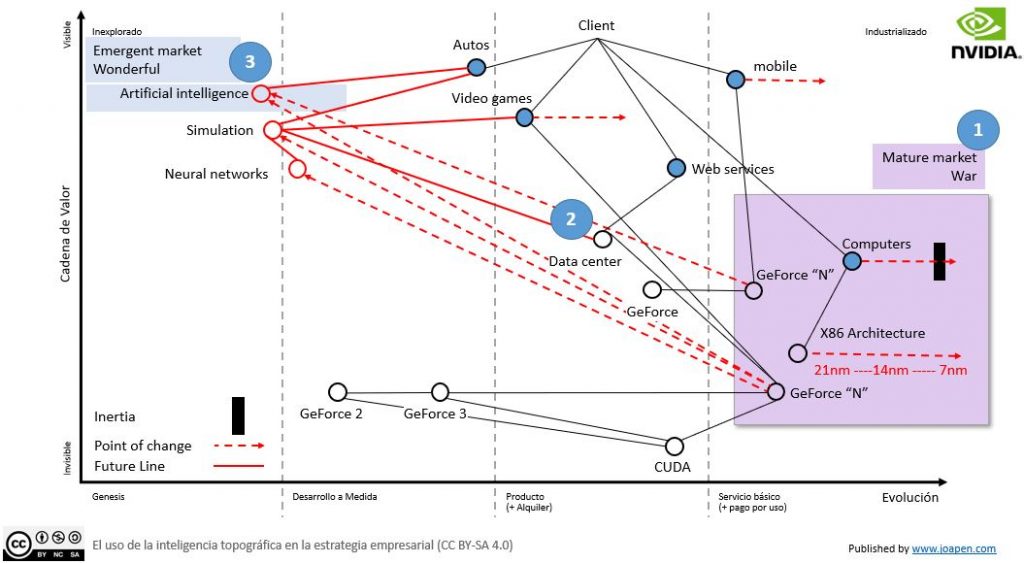

This map tries to visualize the situation of this company in 2020. Focusing on trying to understand its current situation and where its investments are going.

The map

The Players

2018 – 2019 table

I’ll use this 2018 and 2019 billing table as a reference to see who the top players in the industry are.

We can see that companies like AMD are not in this table of 15 companies. And that others like TSMC are doing very well and are not known.

Q1 2020 – 2021 table

Nvidia jumps to 8th position of the list.

Well, let’s focus on NVIDIA, the tenth on the list.

Point 1.- Area where the market is mature, war zone

In this market for computers and graphic display and video games are in a high degree of industrialization and maturity.

The war is focused on:

- Be the fastest to release the next versions of chips with less size (now the struggle is to get the 7nm one in a stable way and producing massively).

- The struggle to shrink lithography always fills the media covers, but this is not a definite competitive aspect (there are many others).

- Note that TSCM plans to release the 3nm lithography at the end of 2021, which is when Intel plans to release the 7nm one.

- To continue to be a benchmark differentiated from competitors (Intel, Samsung, Micron, Qualcomm, AMD).

- Continue to work with large, higher-order manufacturers and shield these large customers from other competitors.

- It is in this area where companies are making the most money right now and where margins are slowly falling.

- In 2007 NVIDIA launched Compute Unified Device Architecture (CUDA), that is a software architecture that enables the developers to turn a GPU (Generic Process Unit) into a “more concrete process unit”. This link between hardware and software is in the culture of the company.

The computer market is a market in decline due to the use of tablets and mobiles. That’s why the focus for billing growth is on data centers.

Point 2.- Data centers

The number of services and the volume of data processing continues to grow exponentially and it is recognized that the data center business is one of the areas that still has the capacity for growth with a not negligible volume.

This is where the entire industry is making a lot of effort, both organically and through acquisitions.

To consider:

- Acquisition of Mellanox Technologies , which provides end-to-end connectivity solutions for servers and storage that optimize data center performance. (2019 – 6.9B $).

- Acquisition of SwiftStack , its innovations power private cloud storage for enterprises, offering the benefit of the public cloud, but at the IT controls of the infrastructure.

- Acquisition of Cumulus Networks , a software company, designs and sells Linux operating systems for network hardware.

- Amazon acquired Annapurna Labs in 2016 to be able to dispose of its semiconductor area, recognizing the need to be present in this area of the business that is critical for them. Facebook announced intentions to make investments in this regard in 2019, but at least I have not read more about it.

- Google and NVIDIA have announced improvements in the execution speeds of their Machine Learning systems, these types of close collaborations are very relevant and provide value, billing and brand image.

By comparing with Intel (the leader in the market), they acquired Habana Labs , which is a semiconductor company that focuses on developing disruptive solutions for the data center and cloud efficiency. They also acquired Rivet Networks , which is a technology and products company focused on creating the best possible network experience for users.

AMD for its part has not made any acquisitions since 2017 and Qualcomm since 2014 (I know, I’m just focusing on US market, and I’m ignoring Asian players).

3.- Emerging market, innovation programs

In a market that evolves as fast as that of semiconductors, it is necessary to pay attention to the quality of the innovation programs that companies are doing. The software giants are making great strides on things like bid data, machine learning, neural networks, and artificial intelligence. For this software to be able to function in a reasonable time, it is necessary that there be electronics that allow the massive treatment of data and computing needs.

Points to consider:

- Business development in artificial intelligence is the final goal to be achieved by all companies.

- The development of artificial intelligence depends on the final objective: cars, genetics, retail … here NVIDIA is already developing activities in the automotive sector and the acquisition of Parabricks provides development capacity in genomic analysis (they analyze the complete human genome in less of an hour compared to other competitors who do it in days).

- Development in simulation activities is important for the automotive industry and for video games. Here NVIDIA is carrying out important developments.

- By comparison, AMD is not investing as much in these areas as NVIDIA is. There is a lot of talk about the 7nm competition between Intel and AMD, but in a period of 5 – 10 years, there will be a very wide market in these areas of Artificial Intelligence where the combination of software and hardware is key and where Intel and NVIDIA are key. they are doing much better than AMD.

- The NVIDIA CUDA® Deep Neural Network library (cuDNN) is a GPU-accelerated library of primitives for deep neural networks. What can help cuDNN to us? It basically accelerates the execution of standard routines such as forward and backward convolution, pooling, normalization, and activation layers. On which languages? Caffe2, Chainer, Keras, MATLAB, MxNet, PaddlePaddle, PyTorch, and TensorFlow.

Updates done in May 2021

Some marketing activities they are realizing on Artificial Intelligence field:

- They are hiring grand master competitors in Kaggle. This type of user consumes a lot of CPU and memory for these challenges. These type of profiles reinforce the sotware capabilities they have. In addition to that from marketing point of view, the hardware is announced, right now the GeForce RTX 3090 is the one on the hedge.

- They have launched Jetson Nano, that is a product very similar to Raspberry Pi. They are orienting the projects on the resolution of problems that typically are AI oriented, but you can use it for many other things.

This review is not all that you could do. If you know specific aspects that could improve this map and the analysis (or correct something that is not right), please tell me, there is no perfect map and talking about a map, is how you can improve the understanding of the context and improve details if proceeds.

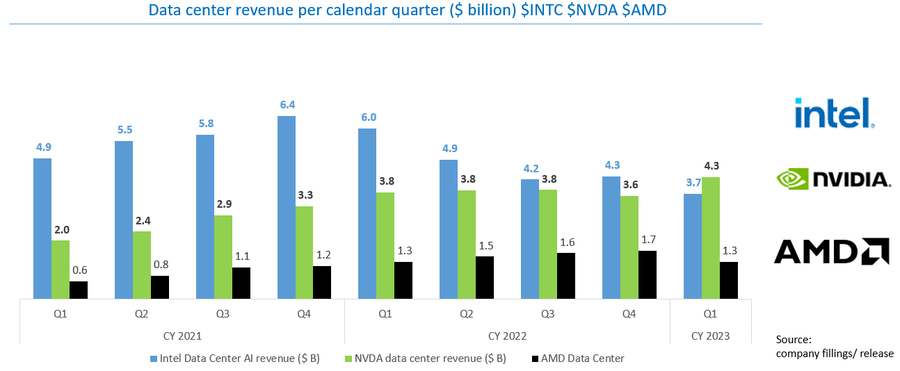

Update done in May 2023

NVIDIA just released the quarterly results and they updated the forecast for the rest of the FY.

- On the results: first quarter where they have more revenue in data center segment than Intel.

- On the forecast: the expectation is too high and the pre-open price increase 25%.

Excelente informe, Joapen! Un gran mercado en inteligencia artificial hay por delante!

Hola Lucky,

me alegro que te haya gustado el informe, si, para poder construir Inteligencia Artificial, primero debemos tener ciertas technologías funcionando. Y si, se abre un nuevo mercado por delante.